Authors

Summary

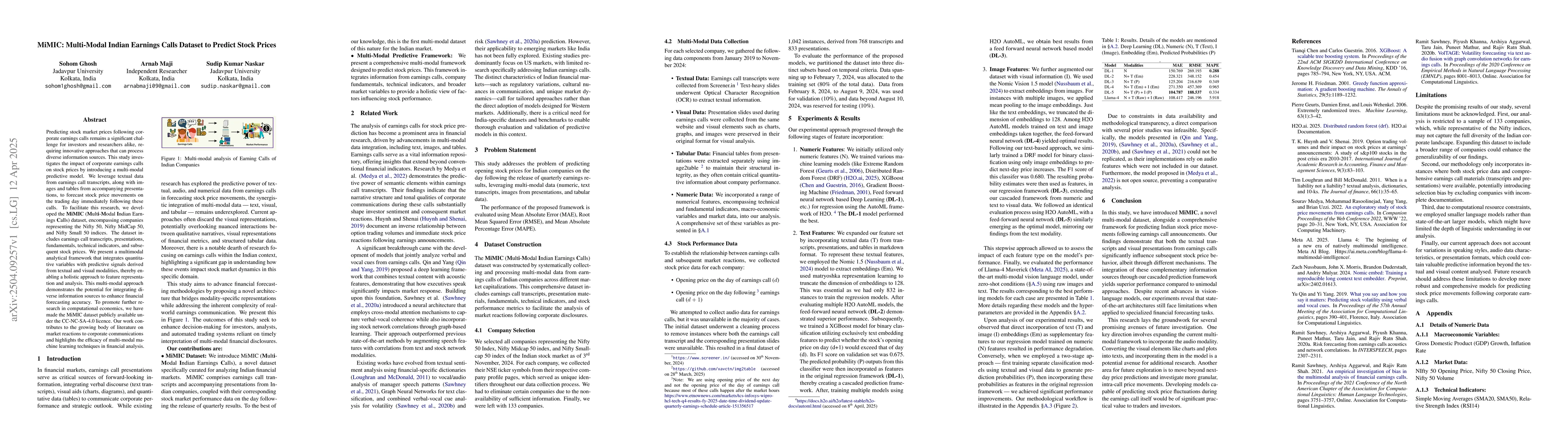

Predicting stock market prices following corporate earnings calls remains a significant challenge for investors and researchers alike, requiring innovative approaches that can process diverse information sources. This study investigates the impact of corporate earnings calls on stock prices by introducing a multi-modal predictive model. We leverage textual data from earnings call transcripts, along with images and tables from accompanying presentations, to forecast stock price movements on the trading day immediately following these calls. To facilitate this research, we developed the MiMIC (Multi-Modal Indian Earnings Calls) dataset, encompassing companies representing the Nifty 50, Nifty MidCap 50, and Nifty Small 50 indices. The dataset includes earnings call transcripts, presentations, fundamentals, technical indicators, and subsequent stock prices. We present a multimodal analytical framework that integrates quantitative variables with predictive signals derived from textual and visual modalities, thereby enabling a holistic approach to feature representation and analysis. This multi-modal approach demonstrates the potential for integrating diverse information sources to enhance financial forecasting accuracy. To promote further research in computational economics, we have made the MiMIC dataset publicly available under the CC-NC-SA-4.0 licence. Our work contributes to the growing body of literature on market reactions to corporate communications and highlights the efficacy of multi-modal machine learning techniques in financial analysis.

AI Key Findings

Generated Jun 09, 2025

Methodology

The study introduces MiMIC, a multi-modal dataset, and a comprehensive framework for predicting Indian stock price movements following earnings call announcements. It integrates textual data from earnings call transcripts, visual elements from presentations, and numerical features like technical and fundamental indicators, macroeconomic variables, and market data.

Key Results

- The dataset and framework significantly improve stock price prediction accuracy compared to unimodal approaches.

- Textual and visual information from earnings calls significantly influence subsequent stock price behavior.

- A two-stage approach, first training separate classification models using textual and visual data to generate prediction probabilities, then incorporating these probabilities as features in the original regression framework, yields substantial performance improvements.

- Despite recent advances in vision-language models, state-of-the-art architectures still face limitations when applied to specialized financial forecasting tasks.

Significance

This research contributes to the growing body of literature on market reactions to corporate communications and highlights the efficacy of multi-modal machine learning techniques in financial analysis. The publicly available MiMIC dataset facilitates further research in computational economics.

Technical Contribution

The paper presents a multi-modal analytical framework that integrates quantitative variables with predictive signals derived from textual and visual modalities, enabling a holistic approach to feature representation and analysis.

Novelty

This is the first multi-modal dataset of this nature for the Indian market, addressing the distinct characteristics of Indian financial markets that call for tailored approaches rather than the direct adoption of models designed for Western markets.

Limitations

- The analysis is restricted to a sample of 133 companies, which may not capture the full diversity of the Indian corporate landscape.

- The methodology only incorporates instances with both stock price data and comprehensive earnings call materials, potentially introducing selection bias.

Future Work

- Expand the current multi-modal framework to incorporate audio modality.

- Convert visual elements like charts and plots into text and incorporate them into the model.

- Move beyond next-day price predictions and investigate more granular, intra-call price movements.

- Develop models capable of predicting stock price fluctuations during the earnings call itself.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Exploratory Study of Stock Price Movements from Earnings Calls

Yang Yang, Sourav Medya, Brian Uzzi et al.

No citations found for this paper.

Comments (0)