Summary

Given the univariate marginals of a real-valued, continuous-time martingale, (respectively, a family of measures parameterised by $t \in [0,T]$ which is increasing in convex order, or a double continuum of call prices) we construct a family of pure-jump martingales which mimic that martingale (respectively, are consistent with the family of measures, or call prices). As an example, we construct a fake Brownian motion. Then, under a further `dispersion' assumption, we construct the martingale which (within the family of martingales which are consistent with a given set of measures) has the smallest expected total variation. We also give a path-wise inequality, which in the mathematical finance context yields a model-independent sub-hedge for an exotic security with payoff equal to the total variation along a realisation of the price process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

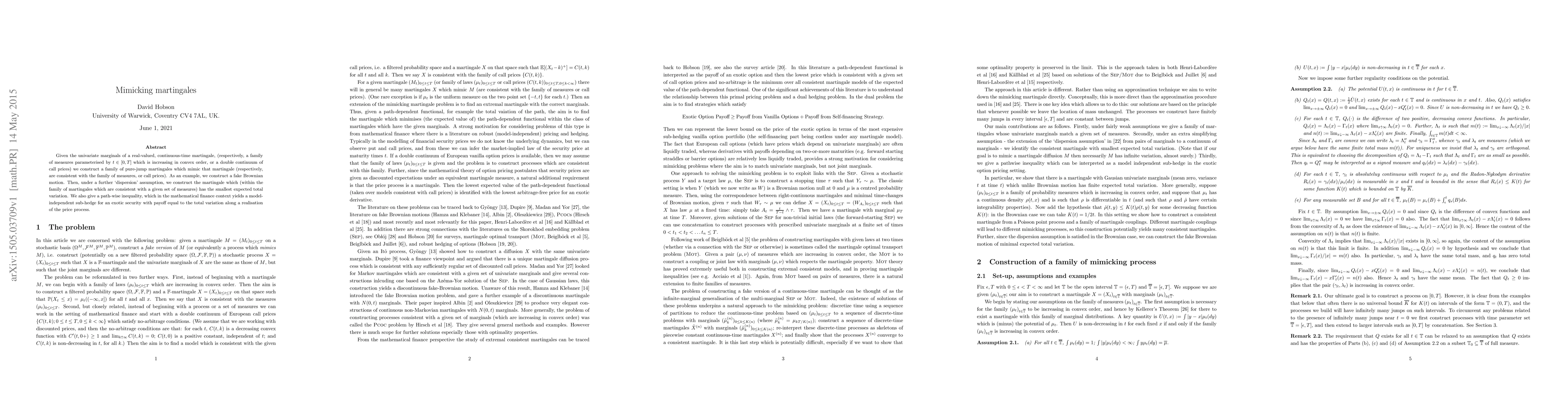

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)