Summary

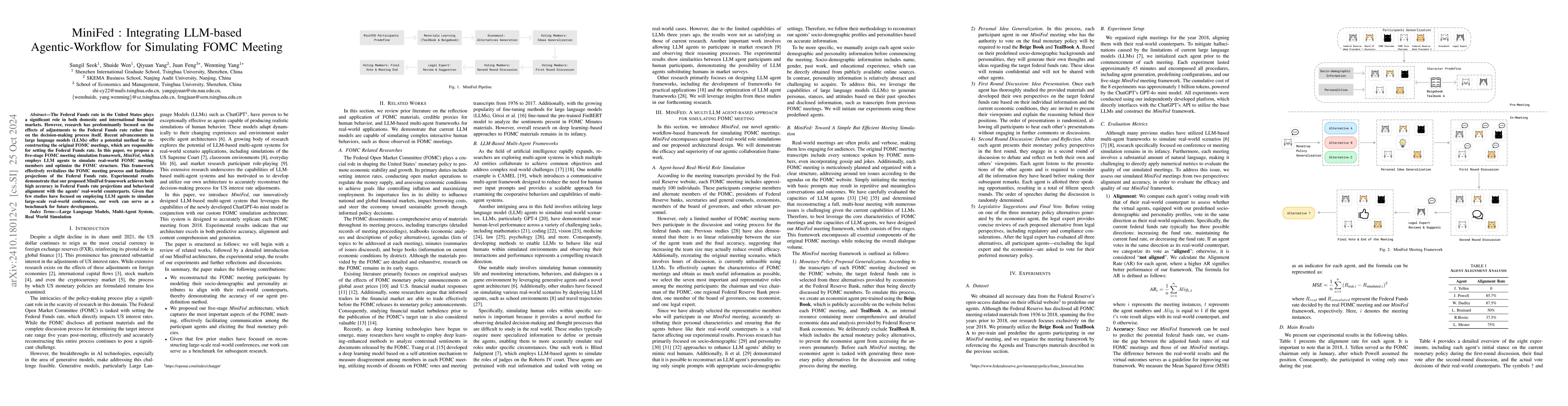

The Federal Funds rate in the United States plays a significant role in both domestic and international financial markets. However, research has predominantly focused on the effects of adjustments to the Federal Funds rate rather than on the decision-making process itself. Recent advancements in large language models(LLMs) offer a potential method for reconstructing the original FOMC meetings, which are responsible for setting the Federal Funds rate. In this paper, we propose a five-stage FOMC meeting simulation framework, MiniFed, which employs LLM agents to simulate real-world FOMC meeting members and optimize the FOMC structure. This framework effectively revitalizes the FOMC meeting process and facilitates projections of the Federal Funds rate. Experimental results demonstrate that our proposed MiniFed framework achieves both high accuracy in Federal Funds rate projections and behavioral alignment with the agents' real-world counterparts. Given that few studies have focused on employing LLM agents to simulate large-scale real-world conferences, our work can serve as a benchmark for future developments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAIPatient: Simulating Patients with EHRs and LLM Powered Agentic Workflow

Xiang Li, Zhao Li, Yang Zhou et al.

QualityFlow: An Agentic Workflow for Program Synthesis Controlled by LLM Quality Checks

Qiang Zhou, Yaojie Hu, Dejiao Zhang et al.

GNNs as Predictors of Agentic Workflow Performances

Muhan Zhang, Shuo Chen, Xiaowen Dong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)