Summary

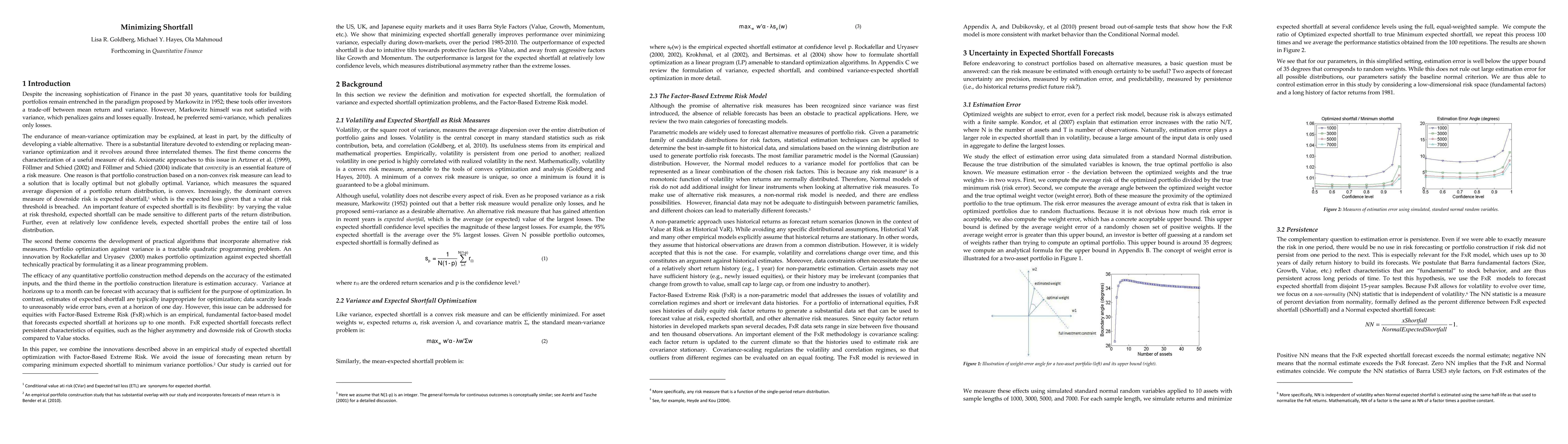

This paper describes an empirical study of shortfall optimization with Barra Extreme Risk. We compare minimum shortfall to minimum variance portfolios in the US, UK, and Japanese equity markets using Barra Style Factors (Value, Growth, Momentum, etc.). We show that minimizing shortfall generally improves performance over minimizing variance, especially during down-markets, over the period 1985-2010. The outperformance of shortfall is due to intuitive tilts towards protective factors like Value, and away from aggressive factors like Growth and Momentum. The outperformance is largest for the shortfall that measures overall asymmetry rather than the extreme losses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)