Summary

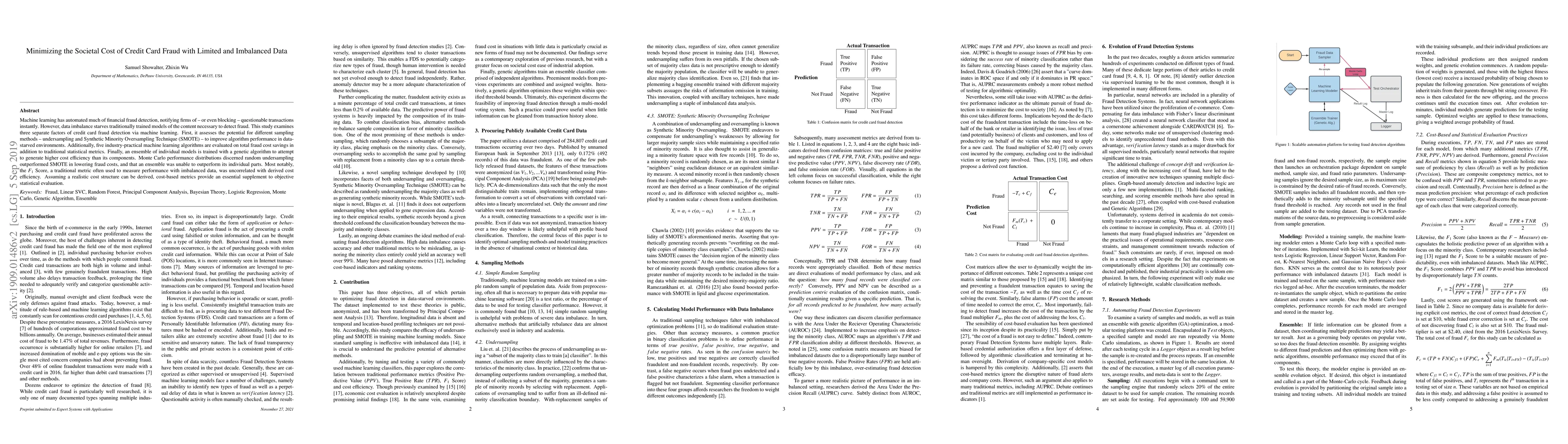

Machine learning has automated much of financial fraud detection, notifying firms of, or even blocking, questionable transactions instantly. However, data imbalance starves traditionally trained models of the content necessary to detect fraud. This study examines three separate factors of credit card fraud detection via machine learning. First, it assesses the potential for different sampling methods, undersampling and Synthetic Minority Oversampling Technique (SMOTE), to improve algorithm performance in data-starved environments. Additionally, five industry-practical machine learning algorithms are evaluated on total fraud cost savings in addition to traditional statistical metrics. Finally, an ensemble of individual models is trained with a genetic algorithm to attempt to generate higher cost efficiency than its components. Monte Carlo performance distributions discerned random undersampling outperformed SMOTE in lowering fraud costs, and that an ensemble was unable to outperform its individual parts. Most notably,the F-1 Score, a traditional metric often used to measure performance with imbalanced data, was uncorrelated with derived cost efficiency. Assuming a realistic cost structure can be derived, cost-based metrics provide an essential supplement to objective statistical evaluation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection Using Enhanced Random Forest Classifier for Imbalanced Data

Huthaifa I. Ashqar, AlsharifHasan Mohamad Aburbeian

Credit Card Fraud Detection with Subspace Learning-based One-Class Classification

Moncef Gabbouj, Fahad Sohrab, Juho Kanniainen et al.

Credit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

| Title | Authors | Year | Actions |

|---|

Comments (0)