Summary

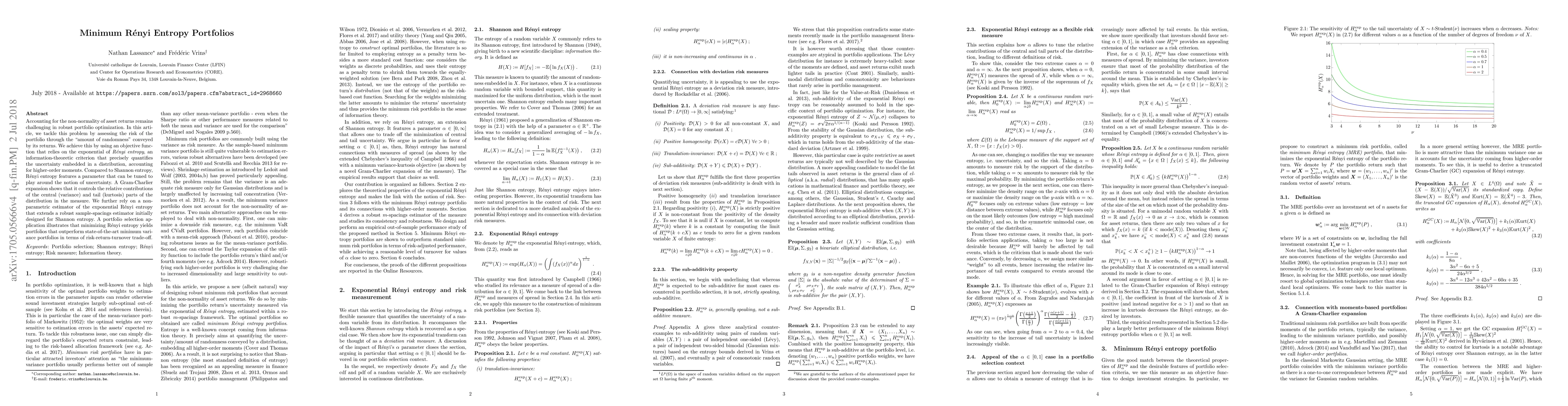

Accounting for the non-normality of asset returns remains challenging in robust portfolio optimization. In this article, we tackle this problem by assessing the risk of the portfolio through the "amount of randomness" conveyed by its returns. We achieve this by using an objective function that relies on the exponential of R\'enyi entropy, an information-theoretic criterion that precisely quantifies the uncertainty embedded in a distribution, accounting for higher-order moments. Compared to Shannon entropy, R\'enyi entropy features a parameter that can be tuned to play around the notion of uncertainty. A Gram-Charlier expansion shows that it controls the relative contributions of the central (variance) and tail (kurtosis) parts of the distribution in the measure. We further rely on a non-parametric estimator of the exponential R\'enyi entropy that extends a robust sample-spacings estimator initially designed for Shannon entropy. A portfolio selection application illustrates that minimizing R\'enyi entropy yields portfolios that outperform state-of-the-art minimum variance portfolios in terms of risk-return-turnover trade-off.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)