Authors

Summary

At the beginning of the COVID-19 outbreak in March, we observed one of the largest stock market crashes in history. Within the months following this, a volatile bullish climb back to pre-pandemic performances and higher. In this paper, we study the stock market behavior during the initial few months of the COVID-19 pandemic in relation to COVID-19 sentiment. Using text sentiment analysis of Twitter data, we look at tweets that contain key words in relation to the COVID-19 pandemic and the sentiment of the tweet to understand whether sentiment can be used as an indicator for stock market performance. There has been previous research done on applying natural language processing and text sentiment analysis to understand the stock market performance, given how prevalent the impact of COVID-19 is to the economy, we want to further the application of these techniques to understand the relationship that COVID-19 has with stock market performance. Our findings show that there is a strong relationship to COVID-19 sentiment derived from tweets that could be used to predict stock market performance in the future.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

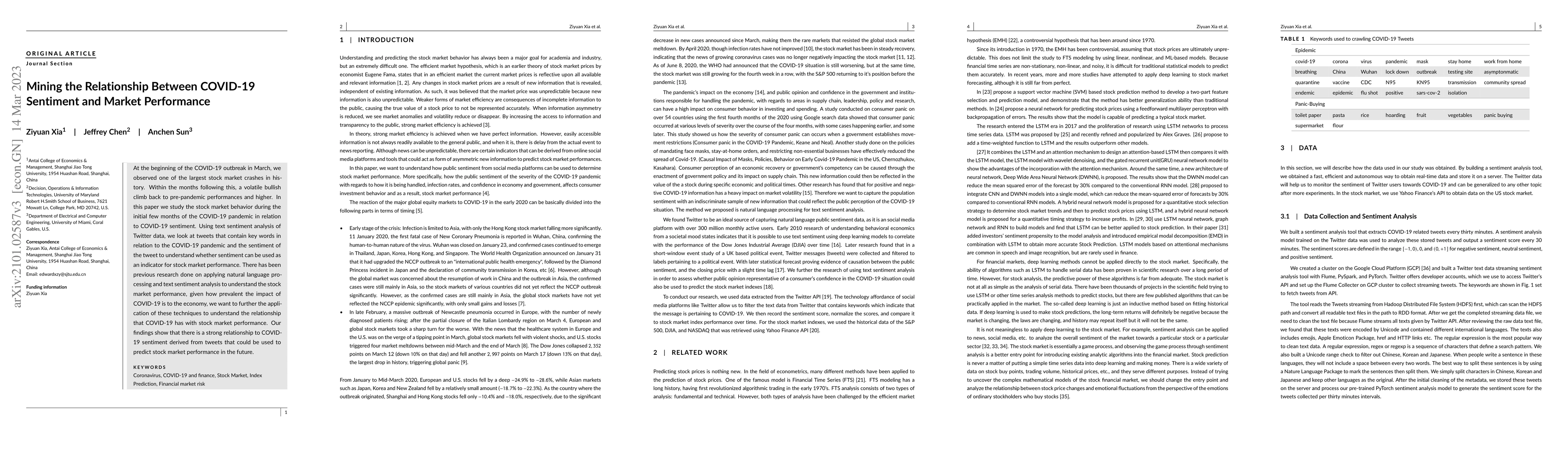

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe relationship between sentiment score and COVID-19 cases in the United States

Truong Luu, Rosangela Follmann

Text mining and sentiment analysis of COVID-19 tweets

Wenqing He, Grace Y. Yi, Qihuang Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)