Summary

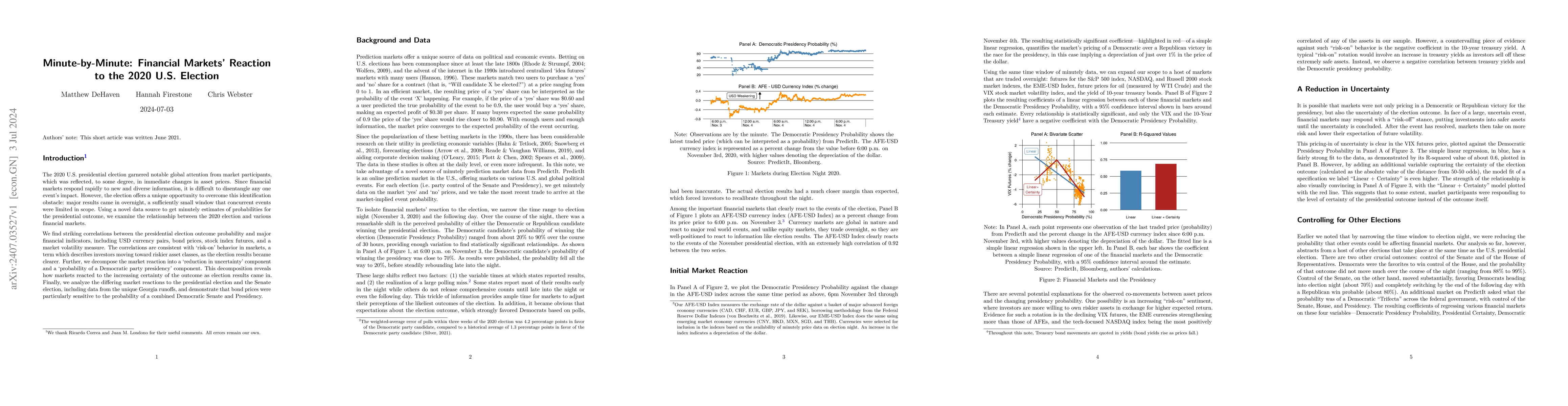

We find striking correlations between the presidential election outcome probability and major financial indicators, including USD currency pairs, bond prices, stock index futures, and a market volatility measure. The correlations are consistent with 'risk-on' behavior in markets, a term which describes investors moving toward riskier asset classes, as the election results became clearer. Further, we decompose the market reaction into a 'reduction in uncertainty' component and a 'probability of a Democratic party presidency' component. This decomposition reveals how markets reacted to the increasing certainty of the outcome as election results came in. Finally, we analyze the differing market reactions to the presidential election and the Senate election, including data from the unique Georgia runoffs, and demonstrate that bond prices were particularly sensitive to the probability of a combined Democratic Senate and Presidency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCast vote records: A database of ballots from the 2020 U.S. Election

Shiro Kuriwaki, Jeffrey B. Lewis, Mason Reece et al.

No citations found for this paper.

Comments (0)