Authors

Summary

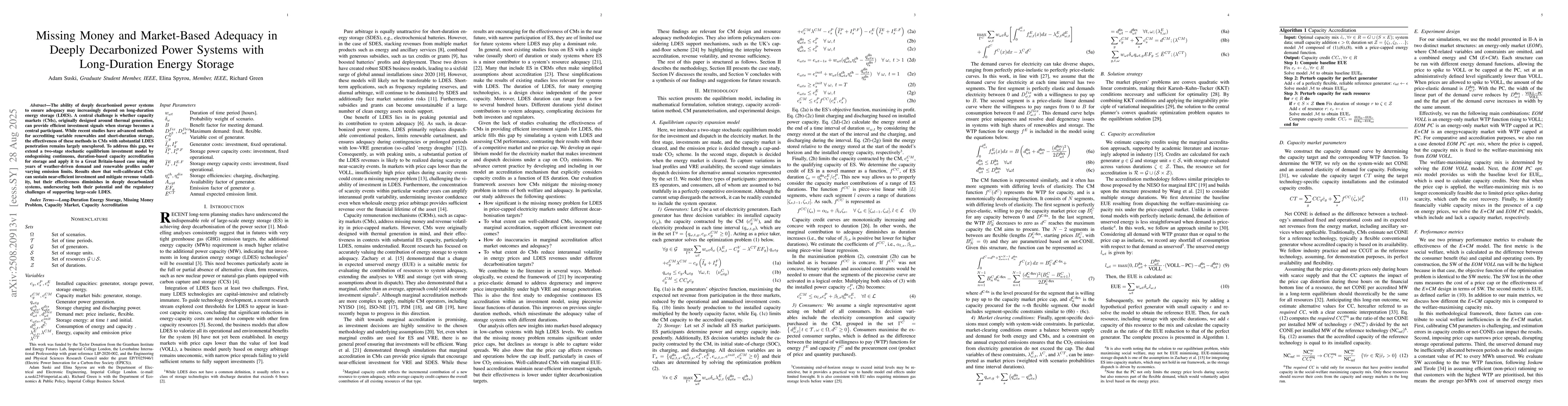

The ability of deeply decarbonised power systems to ensure adequacy may increasingly depend on long-duration energy storage (LDES). A central challenge is whether capacity markets (CMs), originally designed around thermal generation, can provide efficient investment signals when storage becomes a central participant. While recent studies have advanced methods for accrediting variable renewables and short-duration storage, the effectiveness of these methods in CMs with substantial LDES penetration remains largely unexplored. To address this gap, we extend a two-stage stochastic equilibrium investment model by endogenising continuous, duration-based capacity accreditation for storage and apply it to a Great Britain-based case using 40 years of weather-driven demand and renewable profiles under varying emission limits. Results show that well-calibrated CMs can sustain near-efficient investment and mitigate revenue volatility, but their effectiveness diminishes in deeply decarbonized systems, underscoring both their potential and the regulatory challenges of supporting large-scale LDES.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEstablishing best practices for modeling long duration energy storage in deeply decarbonized energy systems

Neha Patankar, Dharik Mallapragada, Gabriel Mantegna et al.

Methodology for Capacity Credit Evaluation of Physical and Virtual Energy Storage in Decarbonized Power System

Peng Li, Ziyi Zhang, Ning Qi et al.

Boundary Technology Costs for Economic Viability of Long-Duration Energy Storage Systems

Alexandre Moreira, Miguel Heleno, Patricia Silva et al.

The Value of Competing Energy Storage in Decarbonized Power Systems

Davide Fioriti, Maximilian Parzen, Aristides Kiprakis

Comments (0)