Summary

We study the asymptotic theory of misspecified models for diffusion processes with noisy nonsynchronous observations. Unlike with correctly specified models, the original maximum-likelihood-type estimator has an asymptotic bias under the misspecified setting and fails to achieve an optimal rate of convergence. To address this, we consider a new quasi-likelihood function that arrows constructing a maximum-likelihood-type estimator that achieves the optimal rate of convergence. Study of misspecified models enables us to apply machine-learning techniques to the maximum-likelihood approach. With these techniques, we can efficiently study the microstructure of a stock market by using rich information of high-frequency data. Neural networks have particularly good compatibility with the maximum-likelihood approach, so we will consider an example of using a neural network for simulation studies and empirical analysis of high-frequency data from the Tokyo Stock Exchange. We demonstrate that the neural network outperforms polynomial models in volatility predictions for major stocks in Tokyo Stock Exchange.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

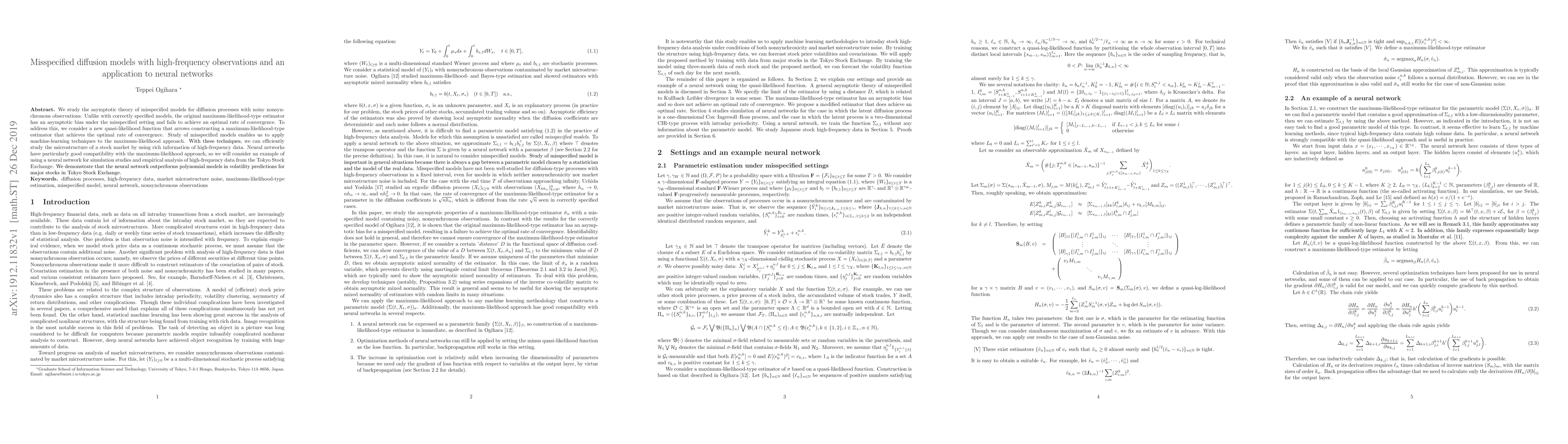

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)