Authors

Summary

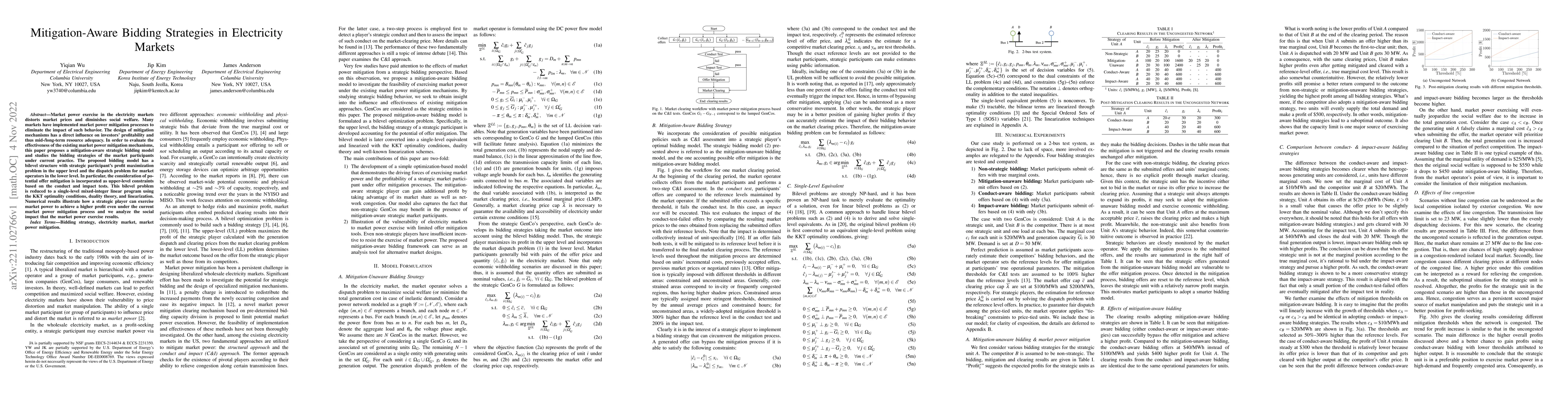

Market power exercise in the electricity markets distorts market prices and diminishes social welfare. Many markets have implemented market power mitigation processes to eliminate the impact of such behavior. The design of mitigation mechanisms has a direct influence on investors' profitability and thus mid-/long-term resource adequacy. In order to evaluate the effectiveness of the existing market power mitigation mechanisms, this paper proposes a mitigation-aware strategic bidding model and studies the bidding strategies of the market participants under current practice. The proposed bidding model has a bilevel structure with strategic participant's profit maximization problem in the upper level and the dispatch problem for market operators in the lower level. In particular, the consideration of potential offer mitigation is incorporated as upper-level constraints based on the conduct and impact tests. This bilevel problem is reduced to a single-level mixed-integer linear program using the KKT optimality conditions, duality theory, and linearization. Numerical results illustrate how a strategic player can exercise market power to achieve a higher profit even under the current market power mitigation process and we analyze the social impact that the market power exercise results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimizing Bidding Curves for Renewable Energy in Two-Settlement Electricity Markets

Audun Botterud, Dongwei Zhao, Stefanos Delikaraogloub et al.

Temporal-Aware Deep Reinforcement Learning for Energy Storage Bidding in Energy and Contingency Reserve Markets

Hao Wang, Yanru Zhang, Jinhao Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)