Authors

Summary

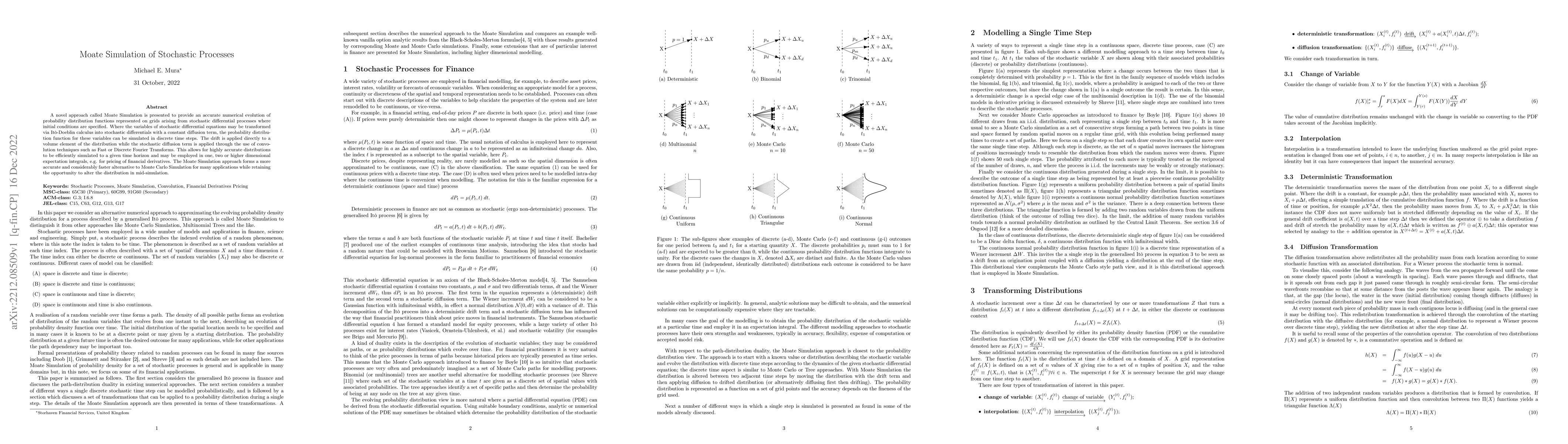

A novel approach called Moate Simulation is presented to provide an accurate numerical evolution of probability distribution functions represented on grids arising from stochastic differential processes where initial conditions are specified. Where the variables of stochastic differential equations may be transformed via It\^o-Doeblin calculus into stochastic differentials with a constant diffusion term, the probability distribution function for these variables can be simulated in discrete time steps. The drift is applied directly to a volume element of the distribution while the stochastic diffusion term is applied through the use of convolution techniques such as Fast or Discrete Fourier Transforms. This allows for highly accurate distributions to be efficiently simulated to a given time horizon and may be employed in one, two or higher dimensional expectation integrals, e.g. for pricing of financial derivatives. The Moate Simulation approach forms a more accurate and considerably faster alternative to Monte Carlo Simulation for many applications while retaining the opportunity to alter the distribution in mid-simulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Confidence Bands for Stochastic Processes Using Simulation

Vahid Sarhangian, Jangwon Park, Timothy Chan

No citations found for this paper.

Comments (0)