Summary

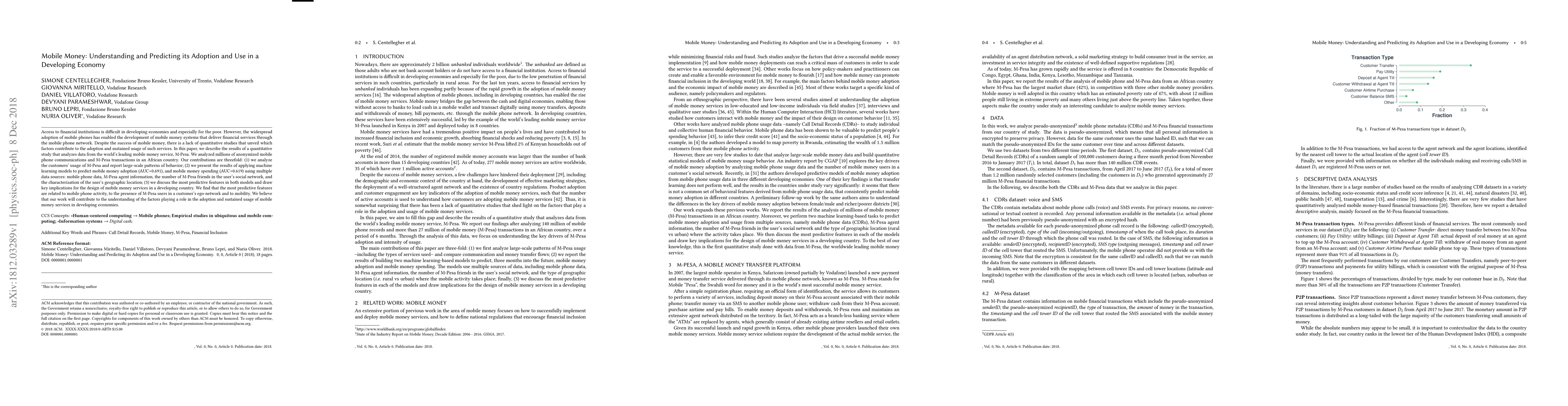

Access to financial institutions is difficult in developing economies and especially for the poor. However, the widespread adoption of mobile phones has enabled the development of mobile money systems that deliver financial services through the mobile phone network. Despite the success of mobile money, there is a lack of quantitative studies that unveil which factors contribute to the adoption and sustained usage of such services. In this paper, we describe the results of a quantitative study that analyzes data from the world's leading mobile money service, M-Pesa. We analyzed millions of anonymized mobile phone communications and M-Pesa transactions in an African country. Our contributions are threefold: (1) we analyze the customers' usage of M-Pesa and report large-scale patterns of behavior; (2) we present the results of applying machine learning models to predict mobile money adoption (AUC=0.691), and mobile money spending (AUC=0.619) using multiple data sources: mobile phone data, M-Pesa agent information, the number of M-Pesa friends in the user's social network, and the characterization of the user's geographic location; (3) we discuss the most predictive features in both models and draw key implications for the design of mobile money services in a developing country. We find that the most predictive features are related to mobile phone activity, to the presence of M-Pesa users in a customer's ego-network and to mobility. We believe that our work will contribute to the understanding of the factors playing a role in the adoption and sustained usage of mobile money services in developing economies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)