Authors

Summary

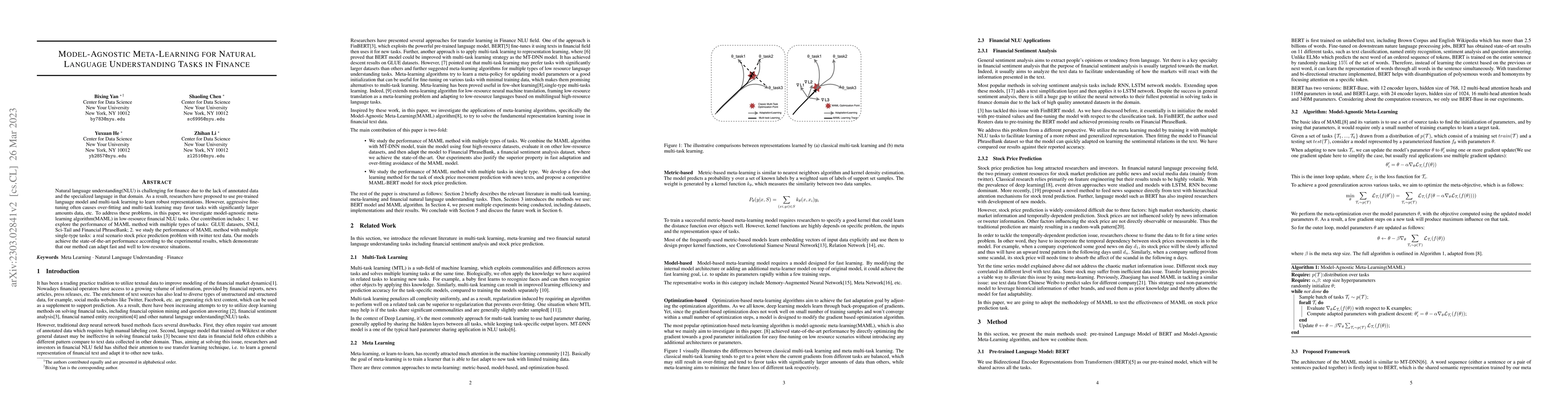

Natural language understanding(NLU) is challenging for finance due to the lack of annotated data and the specialized language in that domain. As a result, researchers have proposed to use pre-trained language model and multi-task learning to learn robust representations. However, aggressive fine-tuning often causes over-fitting and multi-task learning may favor tasks with significantly larger amounts data, etc. To address these problems, in this paper, we investigate model-agnostic meta-learning algorithm(MAML) in low-resource financial NLU tasks. Our contribution includes: 1. we explore the performance of MAML method with multiple types of tasks: GLUE datasets, SNLI, Sci-Tail and Financial PhraseBank; 2. we study the performance of MAML method with multiple single-type tasks: a real scenario stock price prediction problem with twitter text data. Our models achieve the state-of-the-art performance according to the experimental results, which demonstrate that our method can adapt fast and well to low-resource situations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIs Bayesian Model-Agnostic Meta Learning Better than Model-Agnostic Meta Learning, Provably?

Tianyi Chen, Lisha Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)