Summary

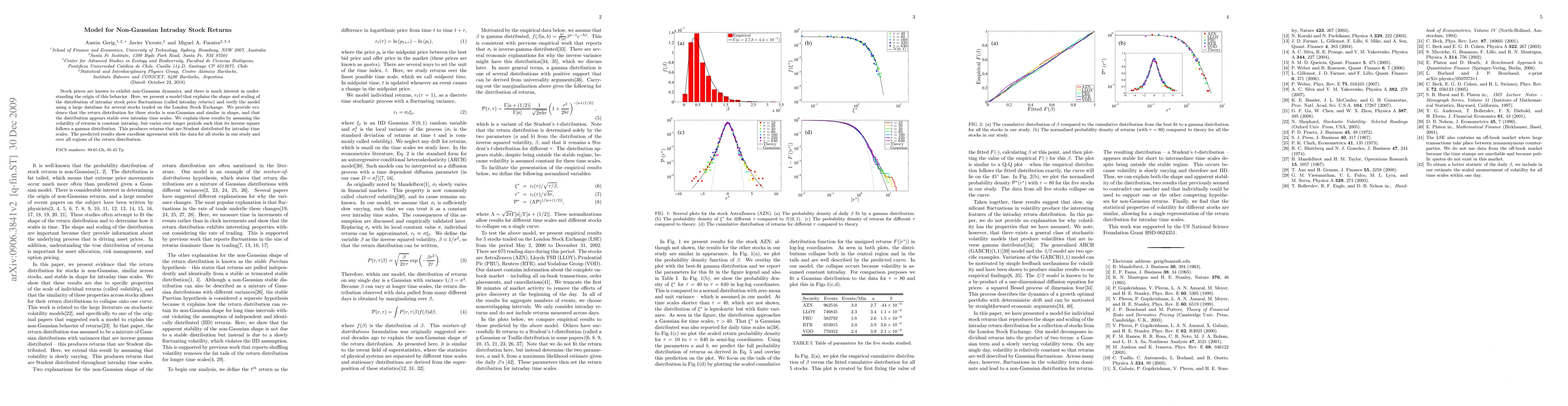

Stock prices are known to exhibit non-Gaussian dynamics, and there is much interest in understanding the origin of this behavior. Here, we present a model that explains the shape and scaling of the distribution of intraday stock price fluctuations (called intraday returns) and verify the model using a large database for several stocks traded on the London Stock Exchange. We provide evidence that the return distribution for these stocks is non-Gaussian and similar in shape, and that the distribution appears stable over intraday time scales. We explain these results by assuming the volatility of returns is constant intraday, but varies over longer periods such that its inverse square follows a gamma distribution. This produces returns that are Student distributed for intraday time scales. The predicted results show excellent agreement with the data for all stocks in our study and over all regions of the return distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)