Summary

We consider Constant Proportion Portfolio Insurance (CPPI) and its dynamic extension, which may be called Dynamic Proportion Portfolio Insurance (DPPI). It is shown that these investment strategies work within the setting of F\"ollmer's pathwise It\^o calculus, which makes no probabilistic assumptions whatsoever. This shows, on the one hand, that CPPI and DPPI are completely independent of any choice of a particular model for the dynamics of asset prices. They even make sense beyond the class of semimartingale sample paths and can be successfully defined for models admitting arbitrage, including some models based on fractional Brownian motion. On the other hand, the result can be seen as a case study for the general issue of robustness in the face of model uncertainty in finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

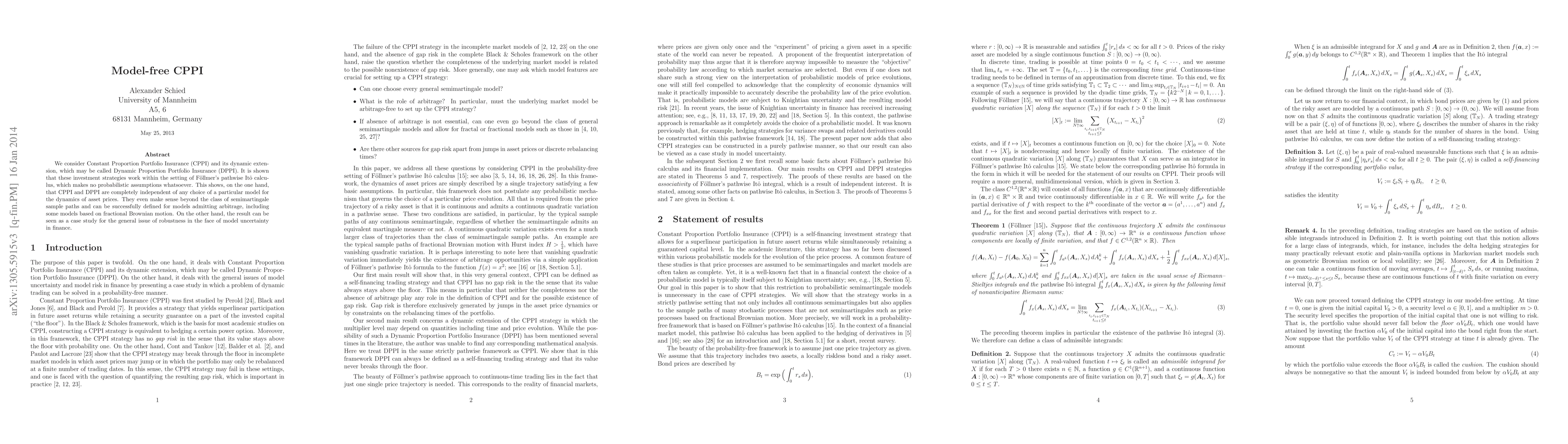

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel-Free Active Exploration in Reinforcement Learning

Alexandre Proutiere, Alessio Russo

Model-Free Robust Reinforcement Learning with Sample Complexity Analysis

Yue Wang, Yudan Wang, Shaofeng Zou

| Title | Authors | Year | Actions |

|---|

Comments (0)