Authors

Summary

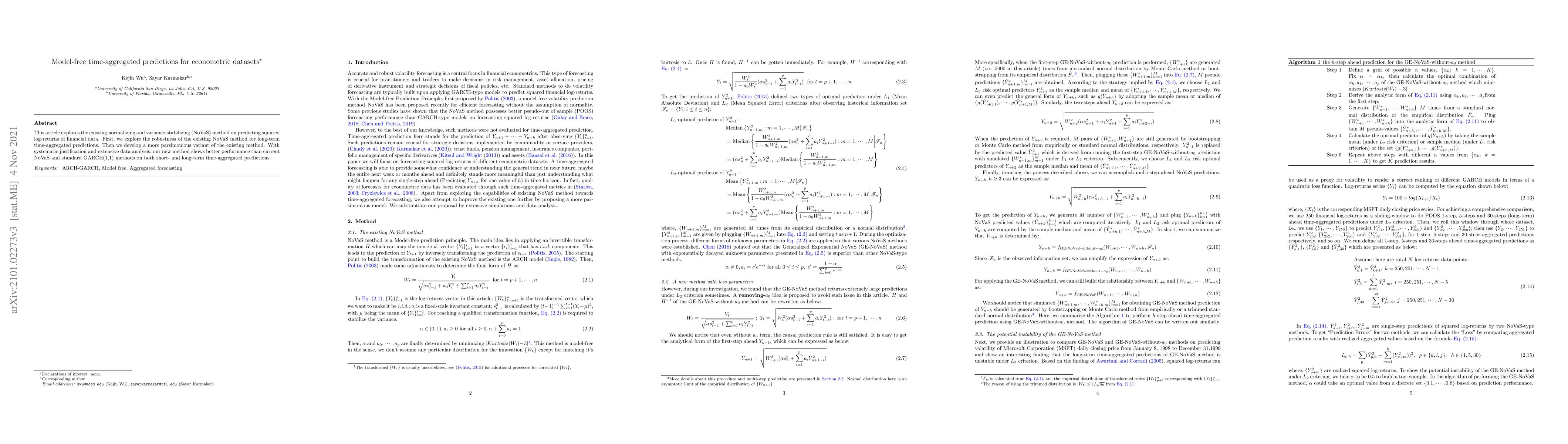

This article explores the existing normalizing and variance-stabilizing (NoVaS) method on predicting squared log-returns of financial data. First, we explore the robustness of the existing NoVaS method for long-term time-aggregated predictions. Then we develop a more parsimonious variant of the existing method. With systematic justification and extensive data analysis, our new method shows better performance than current NoVaS and standard GARCH(1,1) methods on both short- and long-term time-aggregated predictions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSuperensemble Classifier for Improving Predictions in Imbalanced Datasets

Tanujit Chakraborty, Ashis Kumar Chakraborty

| Title | Authors | Year | Actions |

|---|

Comments (0)