Summary

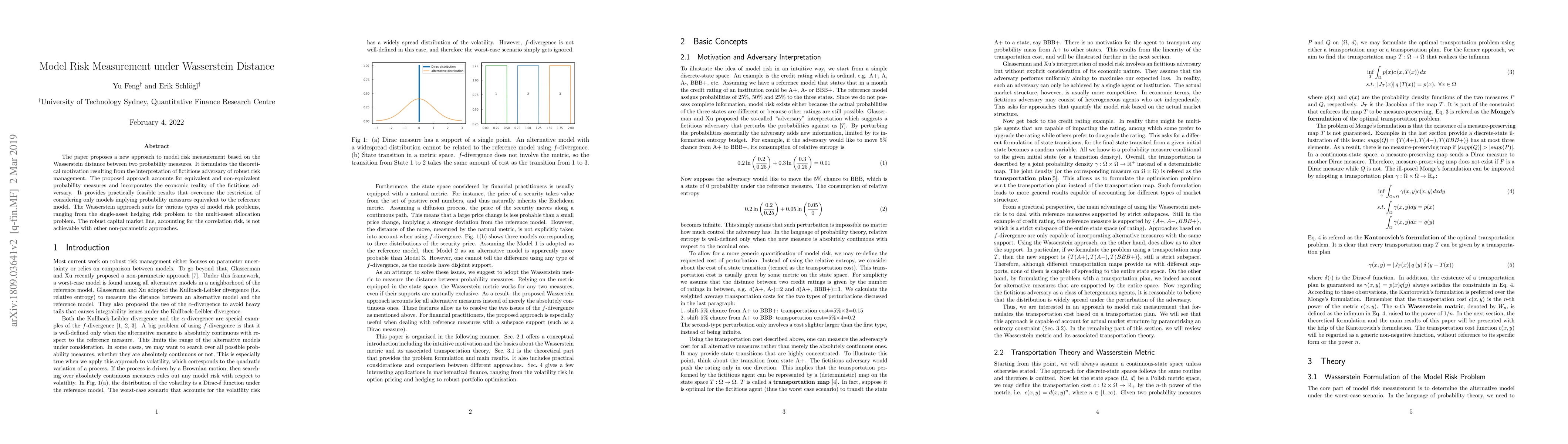

The paper proposes a new approach to model risk measurement based on the Wasserstein distance between two probability measures. It formulates the theoretical motivation resulting from the interpretation of fictitious adversary of robust risk management. The proposed approach accounts for equivalent and non-equivalent probability measures and incorporates the economic reality of the fictitious adversary. It provides practically feasible results that overcome the restriction of considering only models implying probability measures equivalent to the reference model. The Wasserstein approach suits for various types of model risk problems, ranging from the single-asset hedging risk problem to the multi-asset allocation problem. The robust capital market line, accounting for the correlation risk, is not achievable with other non-parametric approaches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Estimation under the Wasserstein Distance

Rachel Cummings, Ziv Goldfeld, Sloan Nietert

Wasserstein Distance-Weighted Adversarial Network for Cross-Domain Credit Risk Assessment

Jingming Pan, Siyuan Han, Hongju Ouyang et al.

Federated Wasserstein Distance

Alain Rakotomamonjy, Kimia Nadjahi, Liva Ralaivola

| Title | Authors | Year | Actions |

|---|

Comments (0)