Summary

We study option pricing and hedging with uncertainty about a Black-Scholes reference model which is dynamically recalibrated to the market price of a liquidly traded vanilla option. For dynamic trading in the underlying asset and this vanilla option, delta-vega hedging is asymptotically optimal in the limit for small uncertainty aversion. The corresponding indifference price corrections are determined by the disparity between the vegas, gammas, vannas, and volgas of the non-traded and the liquidly traded options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

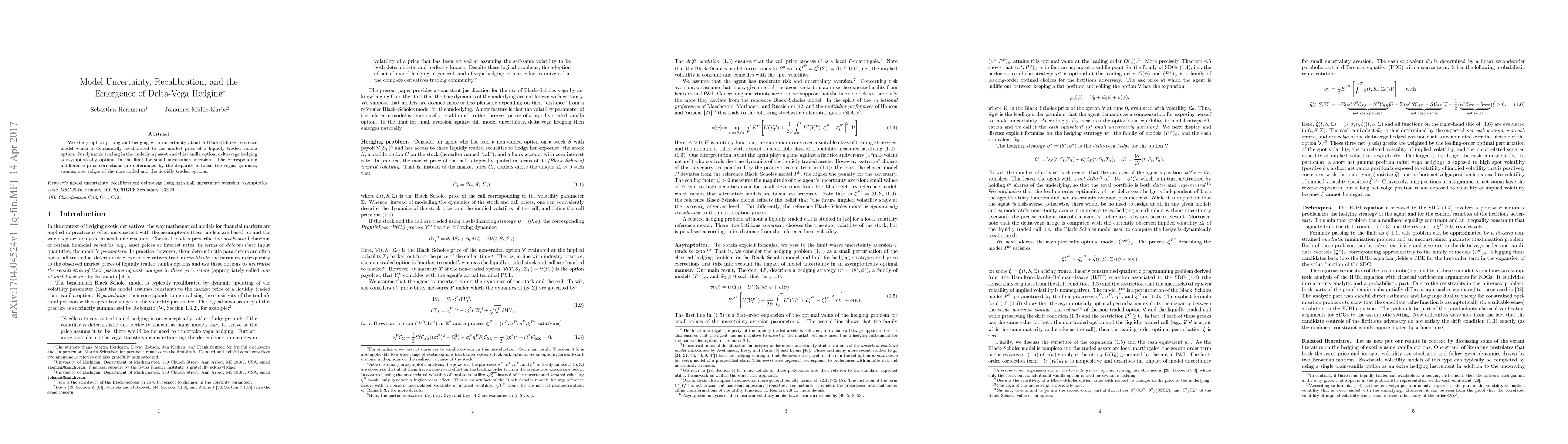

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGamma and Vega Hedging Using Deep Distributional Reinforcement Learning

Zeyu Wang, Jun Yuan, Zissis Poulos et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)