Authors

Summary

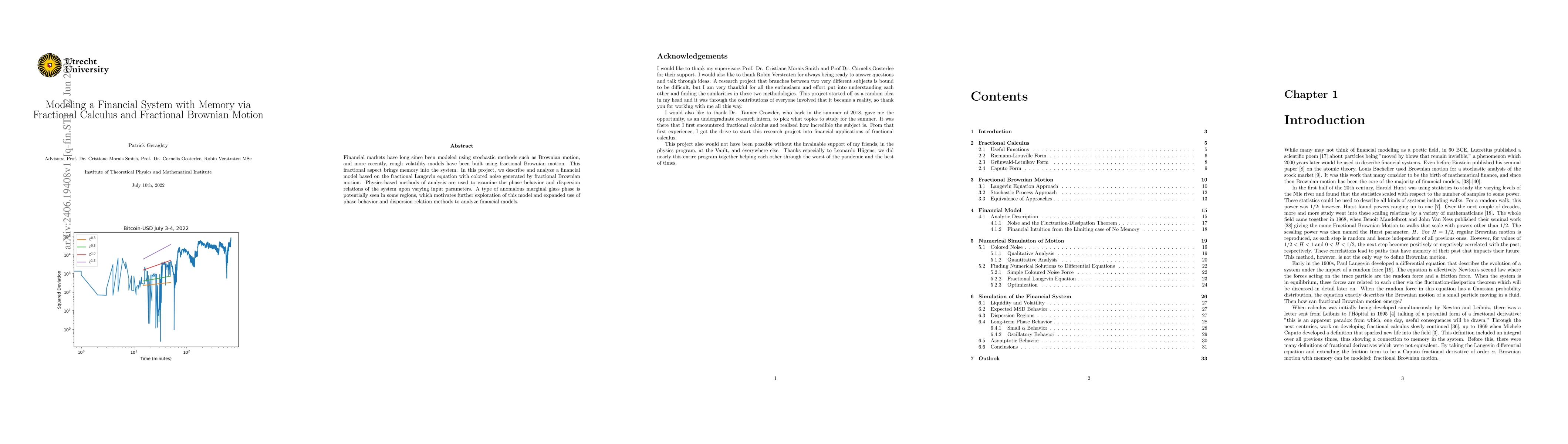

Financial markets have long since been modeled using stochastic methods such as Brownian motion, and more recently, rough volatility models have been built using fractional Brownian motion. This fractional aspect brings memory into the system. In this project, we describe and analyze a financial model based on the fractional Langevin equation with colored noise generated by fractional Brownian motion. Physics-based methods of analysis are used to examine the phase behavior and dispersion relations of the system upon varying input parameters. A type of anomalous marginal glass phase is potentially seen in some regions, which motivates further exploration of this model and expanded use of phase behavior and dispersion relation methods to analyze financial models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)