Authors

Summary

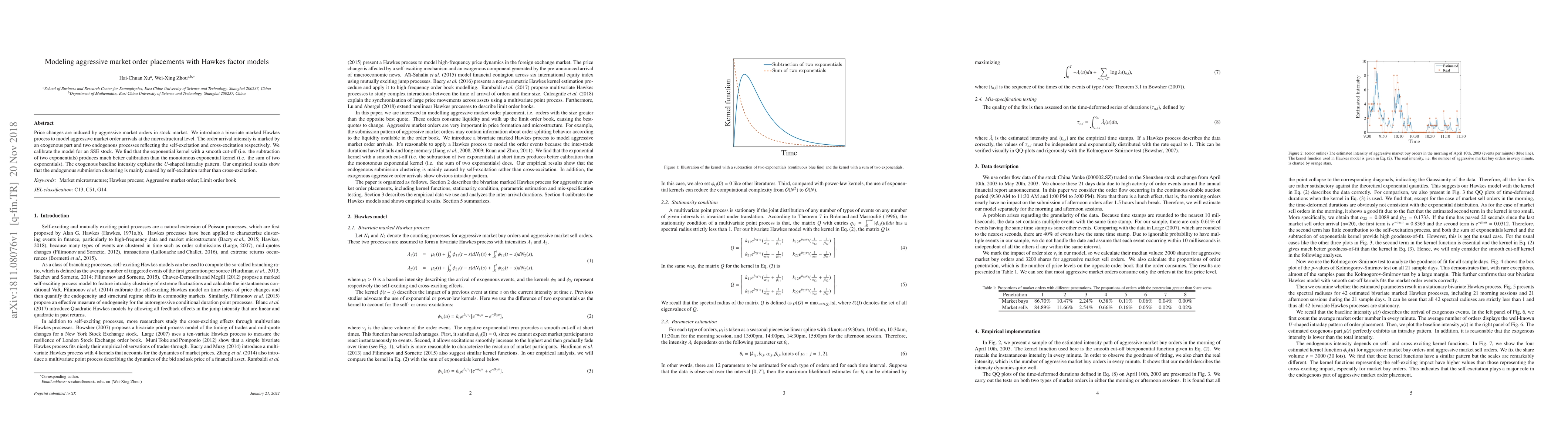

Price changes are induced by aggressive market orders in stock market. We introduce a bivariate marked Hawkes process to model aggressive market order arrivals at the microstructural level. The order arrival intensity is marked by an exogenous part and two endogenous processes reflecting the self-excitation and cross-excitation respectively. We calibrate the model for an SSE stock. We find that the exponential kernel with a smooth cut-off (i.e. the subtraction of two exponentials) produces much better calibration than the monotonous exponential kernel (i.e. the sum of two exponentials). The exogenous baseline intensity explains the $U$-shaped intraday pattern. Our empirical results show that the endogenous submission clustering is mainly caused by self-excitation rather than cross-excitation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOrder Book Queue Hawkes-Markovian Modeling

Shihao Yang, Philip Protter, Qianfan Wu

| Title | Authors | Year | Actions |

|---|

Comments (0)