Summary

In decentralized finance (DeFi), stablecoins like DAI are designed to offer a stable value amidst the fluctuating nature of cryptocurrencies. We examine the class of crypto-backed stable derivatives, with a focus on mechanisms for price stabilization, which is exemplified by the well-known stablecoin DAI from MakerDAO. For simplicity, we focus on a single-collateral setting. We introduce a belief parameter to the simulation model of DAI in a previous work (DAISIM), reflecting market sentiments about the value and stability of DAI, and show that it better matches the expected behavior when this parameter is set to a sufficiently high value. We also propose a simple mathematical model of DAI price to explain its stability and dependency on ETH price. Finally, we analyze possible risk factors associated with these stable derivatives to provide valuable insights for stakeholders in the DeFi ecosystem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

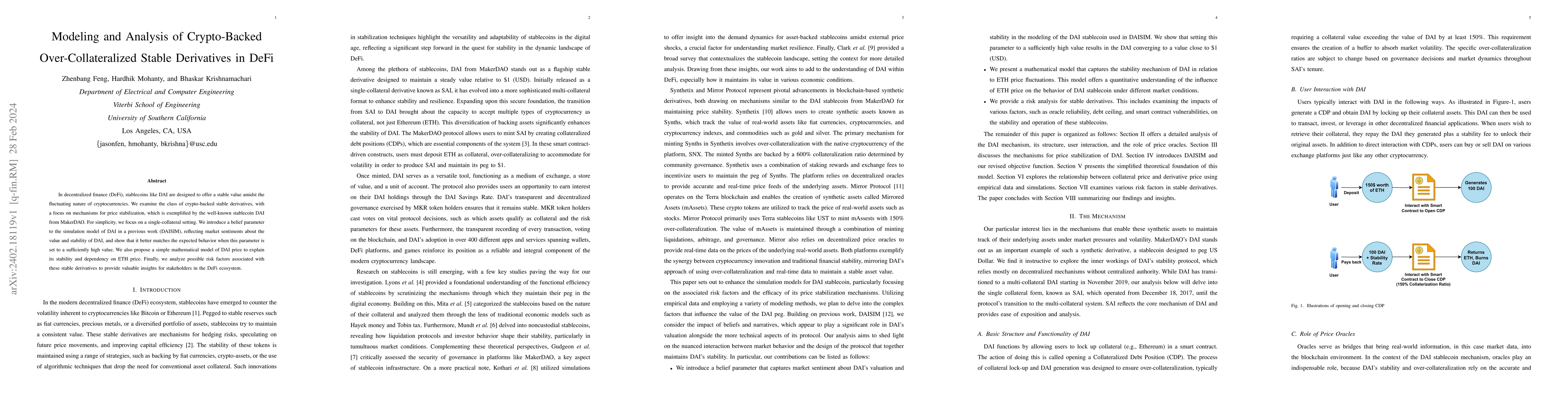

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCollateral Portfolio Optimization in Crypto-Backed Stablecoins

Anwitaman Datta, Bretislav Hajek, Daniel Reijsbergen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)