Summary

It is well known that the probability distribution of high-frequency financial returns is characterized by a leptokurtic, heavy-tailed shape. This behavior undermines the typical assumption of Gaussian log-returns behind the standard approach to risk management and option pricing. Yet, there is no consensus on what class of probability distributions should be adopted to describe financial returns and different models used in the literature have demonstrated, to varying extent, an ability to reproduce empirically observed stylized facts. In order to provide some clarity, in this paper we perform a thorough study of the most popular models of return distributions as obtained in the empirical analyses of high-frequency financial data. We compare the statistical properties and simulate the dynamics of non-Gaussian financial fluctuations by means of Monte Carlo sampling from the different models in terms of realistic tail exponents. Our findings show a noticeable consistency between the considered return distributions in the modeling of the scaling properties of large price changes. We also discuss the convergence rate to the asymptotic distributions of the non-Gaussian stochastic processes and we study, as a first example of possible applications, the impact of our results on option pricing in comparison with the standard Black and Scholes approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

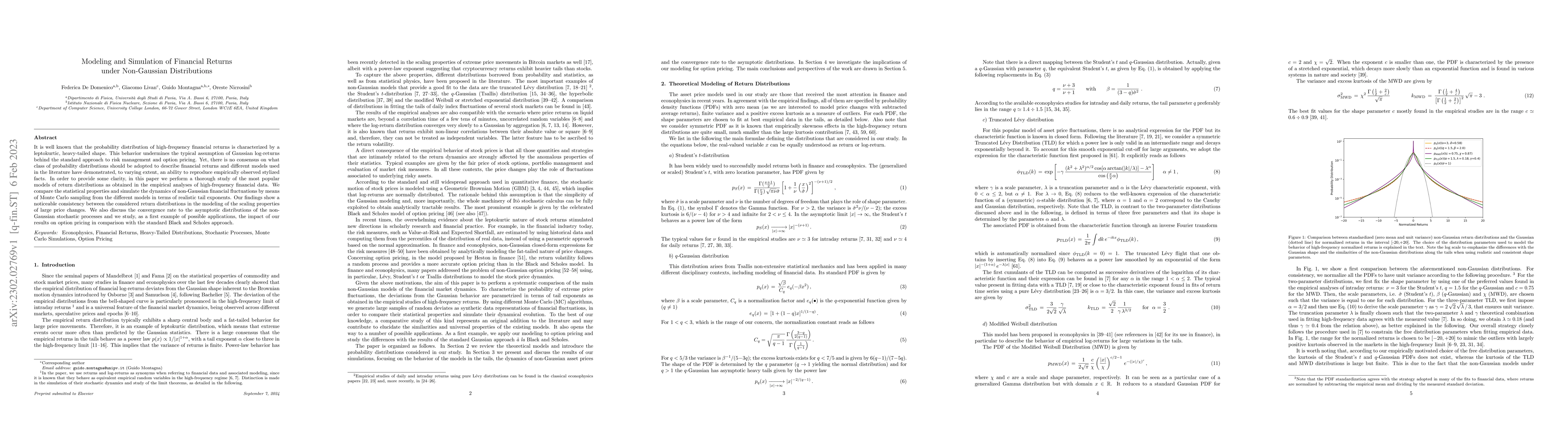

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)