Summary

A micro-scale model is proposed for the evolution of the limit order book. Within this model, the flows of orders (claims) are described by doubly stochastic Poisson processes taking account of the stochastic character of intensities of bid and ask orders that determine the price discovery mechanism in financial markets. The process of {\it order flow imbalance} (OFI) is studied. This process is a sensitive indicator of the current state of the limit order book since time intervals between events in a limit order book are usually so short that price changes are relatively infrequent events. Therefore price changes provide a very coarse and limited description of market dynamics at time micro-scales. The OFI process tracks best bid and ask queues and change much faster than prices. It incorporates information about build-ups and depletions of order queues so that it can be used to interpolate market dynamics between price changes and to track the toxicity of order flows. The {\it two-sided risk processes} are suggested as mathematical models of the OFI process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

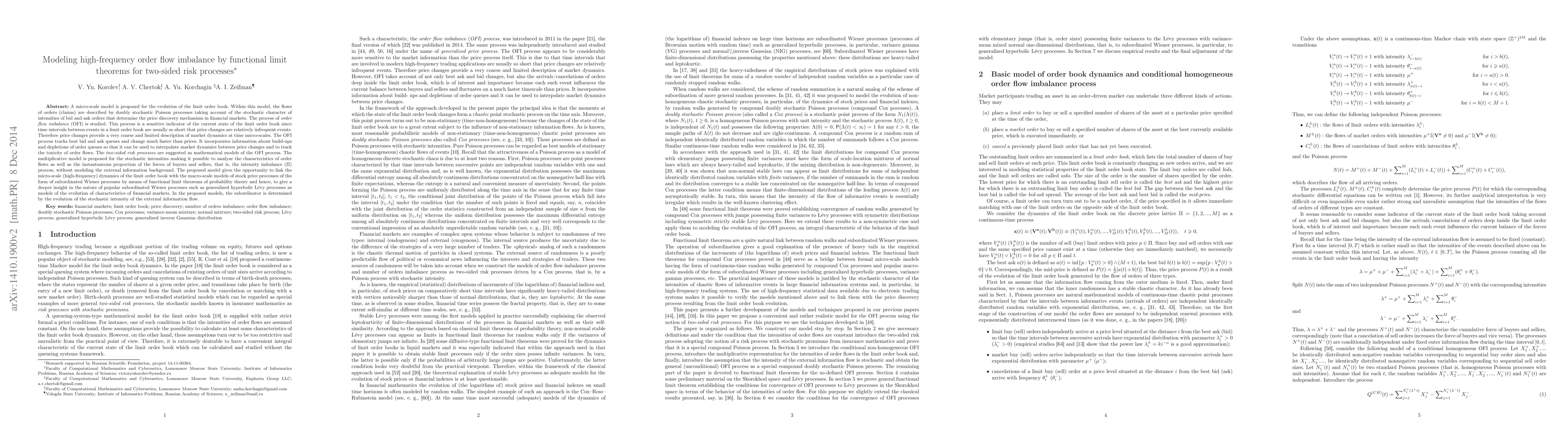

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting High Frequency Order Flow Imbalance

Shashi Jain, Aditya Nittur Anantha

| Title | Authors | Year | Actions |

|---|

Comments (0)