Summary

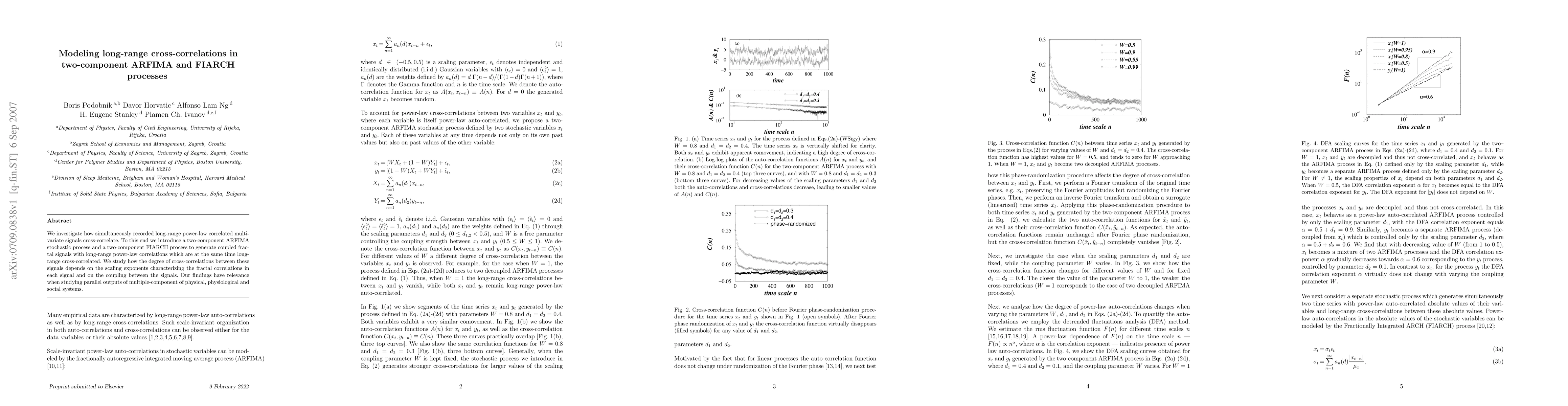

We investigate how simultaneously recorded long-range power-law correlated multi-variate signals cross-correlate. To this end we introduce a two-component ARFIMA stochastic process and a two-component FIARCH process to generate coupled fractal signals with long-range power-law correlations which are at the same time long-range cross-correlated. We study how the degree of cross-correlations between these signals depends on the scaling exponents characterizing the fractal correlations in each signal and on the coupling between the signals. Our findings have relevance when studying parallel outputs of multiple-component of physical, physiological and social systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)