Summary

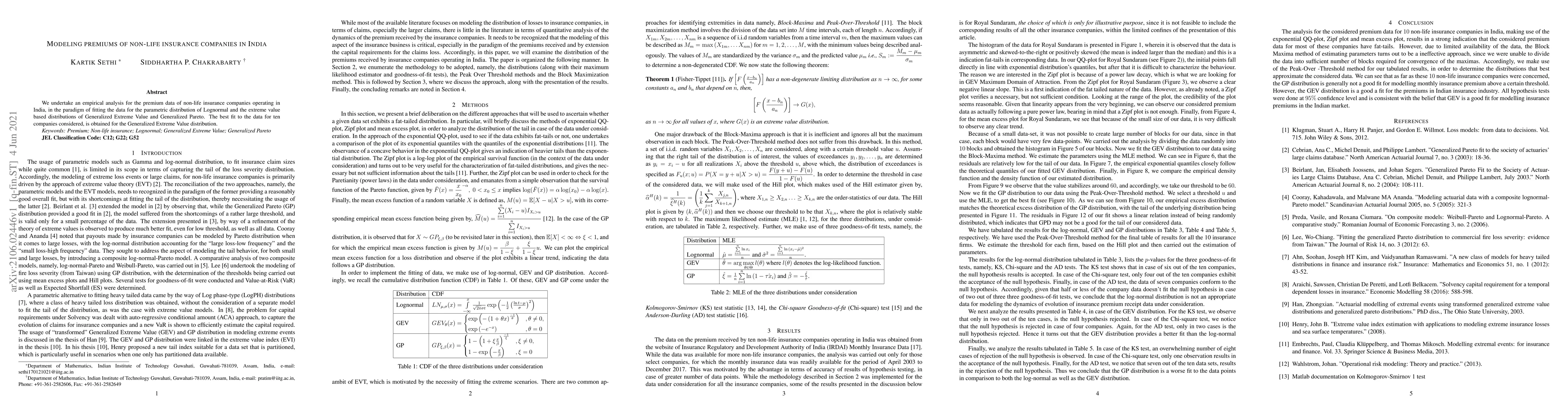

We undertake an empirical analysis for the premium data of non-life insurance companies operating in India, in the paradigm of fitting the data for the parametric distribution of Lognormal and the extreme value based distributions of Generalized Extreme Value and Generalized Pareto. The best fit to the data for ten companies considered, is obtained for the Generalized Extreme Value distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)