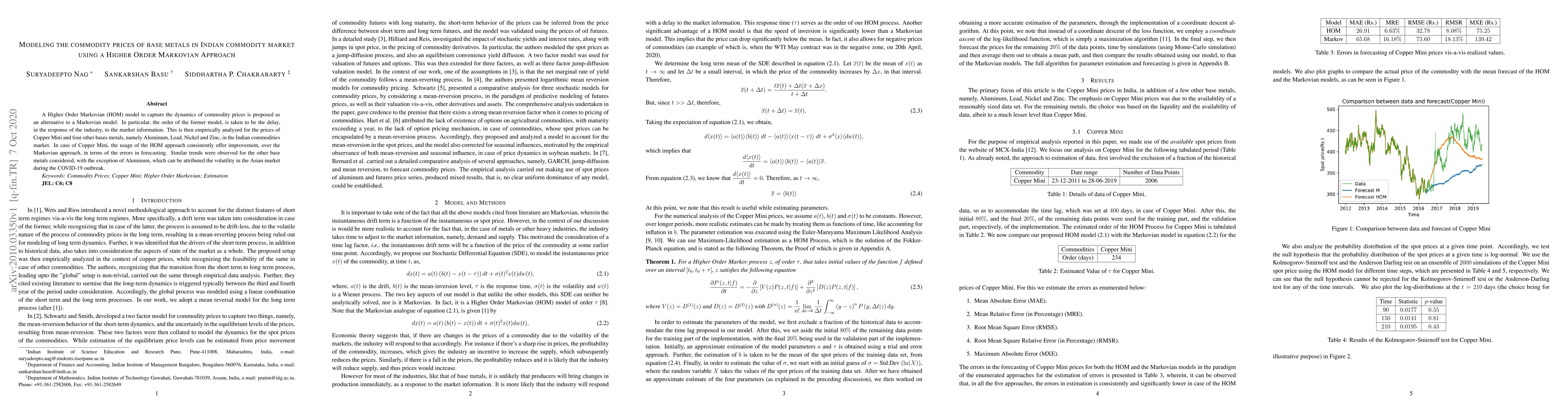

Summary

A Higher Order Markovian (HOM) model to capture the dynamics of commodity prices is proposed as an alternative to a Markovian model. In particular, the order of the former model, is taken to be the delay, in the response of the industry, to the market information. This is then empirically analyzed for the prices of Copper Mini and four other bases metals, namely Aluminum, Lead, Nickel and Zinc, in the Indian commodities market. In case of Copper Mini, the usage of the HOM approach consistently offer improvement, over the Markovian approach, in terms of the errors in forecasting. Similar trends were observed for the other base metals considered, with the exception of Aluminum, which can be attributed the volatility in the Asian market during the COVID-19 outbreak.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterest Rate Dynamics and Commodity Prices

John Stachurski, Christophe Gouel, Qingyin Ma

Interpolating commodity futures prices with Kriging

Andrea Pallavicini, Andrea Maran

| Title | Authors | Year | Actions |

|---|

Comments (0)