Summary

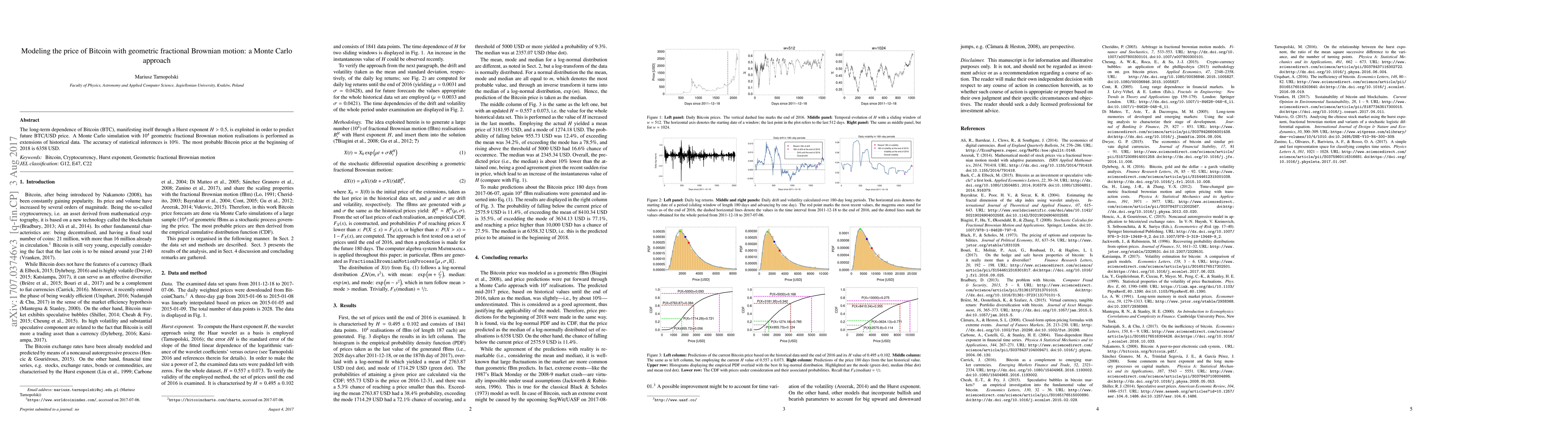

The long-term dependence of Bitcoin (BTC), manifesting itself through a Hurst exponent $H>0.5$, is exploited in order to predict future BTC/USD price. A Monte Carlo simulation with $10^4$ geometric fractional Brownian motion realisations is performed as extensions of historical data. The accuracy of statistical inferences is 10\%. The most probable Bitcoin price at the beginning of 2018 is 6358 USD.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling stock price dynamics on the Ghana Stock Exchange: A Geometric Brownian Motion approach

Dennis Lartey Quayesam, Anani Lotsi, Felix Okoe Mettle

| Title | Authors | Year | Actions |

|---|

Comments (0)