Summary

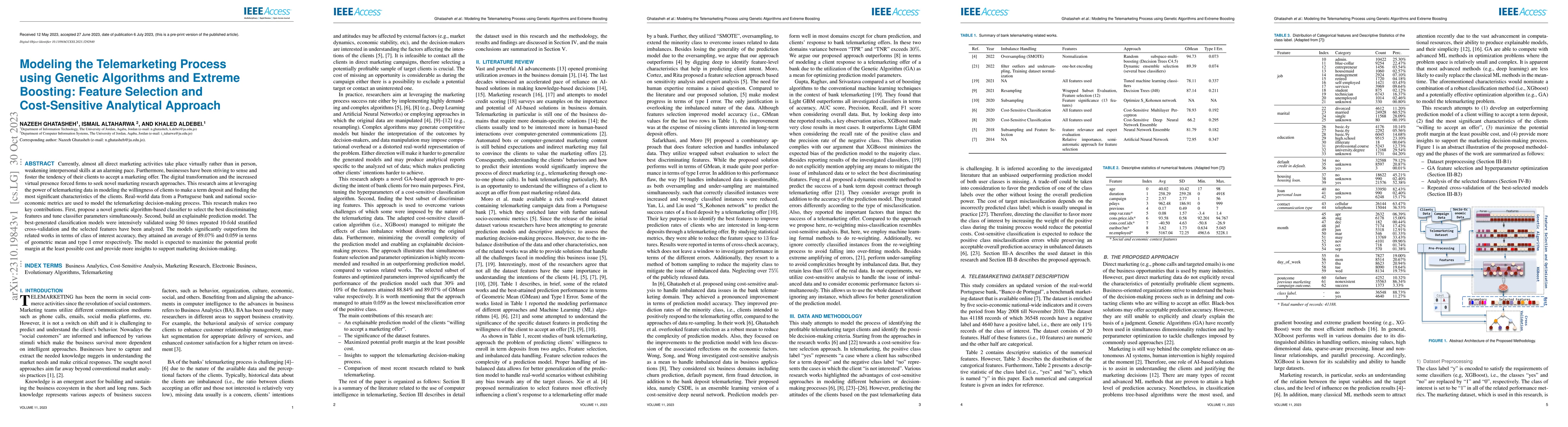

Currently, almost all direct marketing activities take place virtually rather than in person, weakening interpersonal skills at an alarming pace. Furthermore, businesses have been striving to sense and foster the tendency of their clients to accept a marketing offer. The digital transformation and the increased virtual presence forced firms to seek novel marketing research approaches. This research aims at leveraging the power of telemarketing data in modeling the willingness of clients to make a term deposit and finding the most significant characteristics of the clients. Real-world data from a Portuguese bank and national socio-economic metrics are used to model the telemarketing decision-making process. This research makes two key contributions. First, propose a novel genetic algorithm-based classifier to select the best discriminating features and tune classifier parameters simultaneously. Second, build an explainable prediction model. The best-generated classification models were intensively validated using 50 times repeated 10-fold stratified cross-validation and the selected features have been analyzed. The models significantly outperform the related works in terms of class of interest accuracy, they attained an average of 89.07\% and 0.059 in terms of geometric mean and type I error respectively. The model is expected to maximize the potential profit margin at the least possible cost and provide more insights to support marketing decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)