Summary

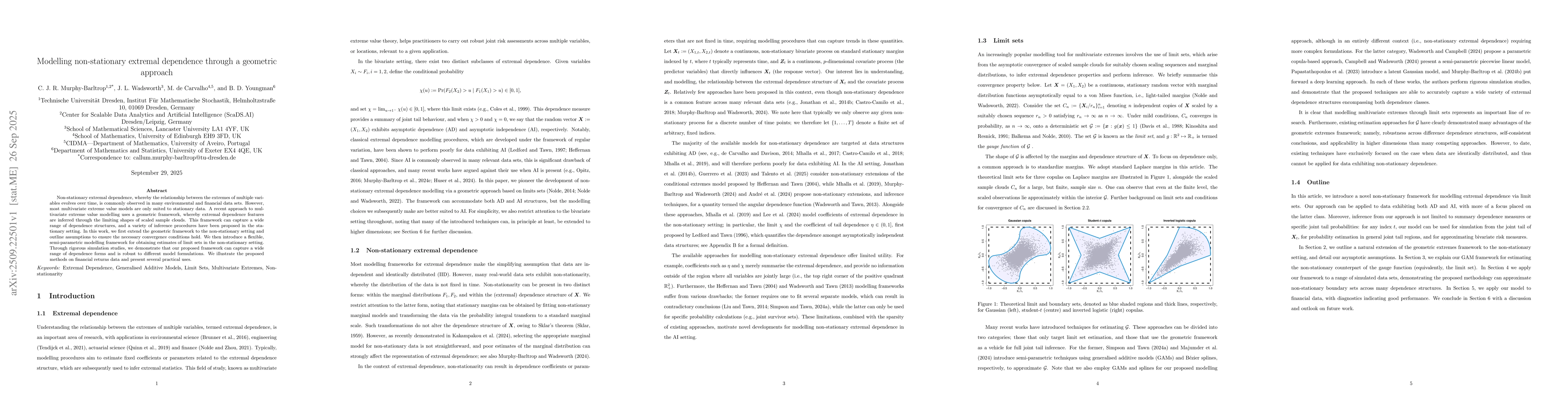

Non-stationary extremal dependence, whereby the relationship between the extremes of multiple variables evolves over time, is commonly observed in many environmental and financial data sets. However, most multivariate extreme value models are only suited to stationary data. A recent approach to multivariate extreme value modelling uses a geometric framework, whereby extremal dependence features are inferred through the limiting shapes of scaled sample clouds. This framework can capture a wide range of dependence structures, and a variety of inference procedures have been proposed in the stationary setting. In this work, we first extend the geometric framework to the non-stationary setting and outline assumptions to ensure the necessary convergence conditions hold. We then introduce a flexible, semi-parametric modelling framework for obtaining estimates of limit sets in the non-stationary setting. Through rigorous simulation studies, we demonstrate that our proposed framework can capture a wide range of dependence forms and is robust to different model formulations. We illustrate the proposed methods on financial returns data and present several practical uses.

AI Key Findings

Generated Oct 01, 2025

Methodology

The research employs a combination of time-series analysis, extreme value theory, and copula modeling to analyze financial returns data. It uses GPD fitting for tail behavior, copula-based dependence modeling, and rolling window parameter estimation for dynamic risk assessment.

Key Results

- The study identifies significant tail dependence across stock pairs, particularly in quadrant 2 (lower-left) for most pairs

- Dynamic threshold quantile estimates show time-varying risk profiles with clear seasonal patterns in dependence

- The proposed marginal model effectively captures both lower and upper tail behaviors with minimal discrepancies in extreme observations

Significance

This research provides a comprehensive framework for understanding time-varying dependence structures in financial markets, enabling better risk management and portfolio optimization strategies through dynamic quantile and return level set analysis.

Technical Contribution

The work introduces a novel integration of GPD modeling with copula-based dependence analysis, combined with time-varying threshold quantile estimation for financial risk assessment.

Novelty

This research uniquely combines extreme value theory with dynamic copula modeling for financial time series, providing a more comprehensive understanding of time-varying tail dependence patterns compared to traditional static models.

Limitations

- The analysis is limited to a specific set of technology stocks, which may not represent broader market behaviors

- The rolling window approach could benefit from more sophisticated smoothing techniques for parameter estimation

Future Work

- Extending the analysis to include more diverse asset classes and market sectors

- Investigating machine learning approaches for improved dependence modeling and parameter estimation

- Developing real-time adaptive risk management systems based on the proposed framework

Paper Details

PDF Preview

Similar Papers

Found 5 papersSpatial extremal modelling: A case study on the interplay between margins and dependence

Emma S. Simpson, Jennifer L. Wadsworth, Lydia Kakampakou

Comments (0)