Authors

Summary

This paper challenges the prevalence of unit root models by introducing the Linear Trend-Stationary Trigonometric ARMA (LTSTA), a novel framework for modelling nonstationary time series under the trend-stationary hypothesis. LTSTA decomposes series into three components: (1) a deterministic trend (modelled via continuous piecewise linear functions with structural breaks), (2) a Fourier-based deterministic seasonality component, and (3) a stochastic ARMA error term. We propose a heuristic approach to determine the optimal number of structural breaks, with parameter estimation performed through an iterative scheme that integrates a modified dynamic programming algorithm for break detection and a standard regression procedure with ARMA errors. The model's performance is evaluated through a case study on US Real GDP (2002-2025), where it accurately identifies breaks corresponding to major economic events (e.g., the 2008 financial crisis and COVID-19 shocks). Additionally, LTSTA outperforms well-established univariate statistical models (SES, Theta, TBATS, ETS, ARIMA, and Prophet) on the CIF 2016 forecasting competition dataset across MAE, RMSE, sMAPE, and MASE metrics. The LTSTA model provides an interpretable alternative to unit root approaches, particularly suited for time series with predominant deterministic properties where structural break detection is critical.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

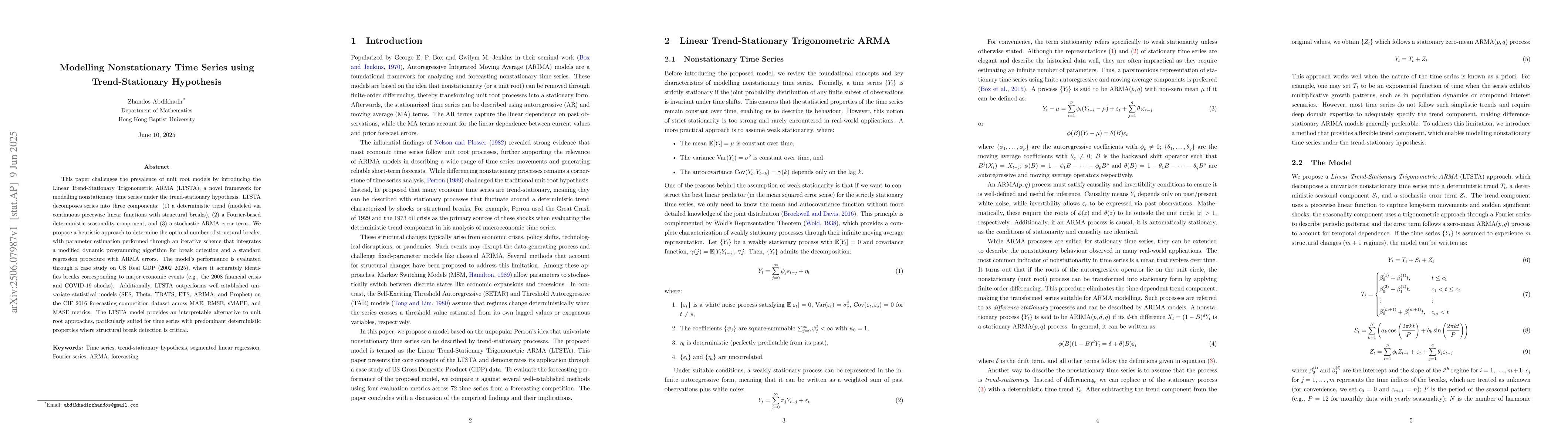

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrendLSW: Trend and Spectral Estimation of Nonstationary Time Series in R

Euan T. McGonigle, Rebecca Killick, Matthew A. Nunes

No citations found for this paper.

Comments (0)