Authors

Summary

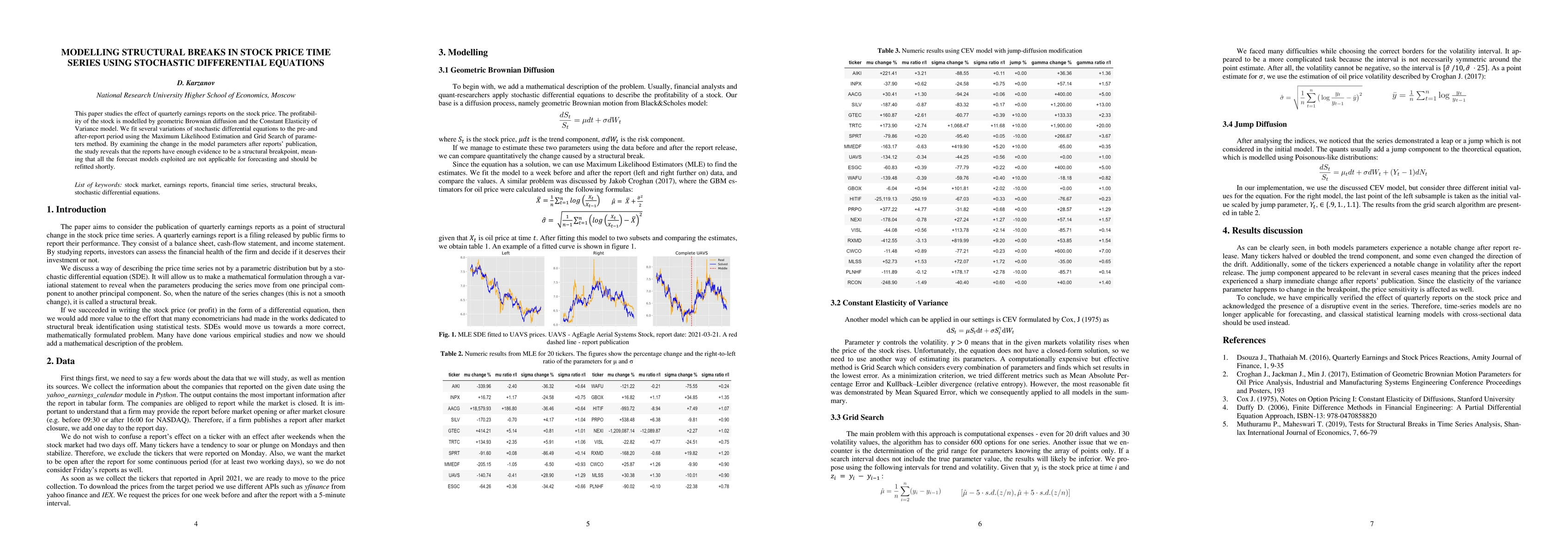

This paper studies the effect of quarterly earnings reports on the stock price. The profitability of the stock is modelled by geometric Brownian diffusion and the Constant Elasticity of Variance model. We fit several variations of stochastic differential equations to the pre-and after-report period using the Maximum Likelihood Estimation and Grid Search of parameters method. By examining the change in the model parameters after reports' publication, the study reveals that the reports have enough evidence to be a structural breakpoint, meaning that all the forecast models exploited are not applicable for forecasting and should be refitted shortly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Model-Based Synthetic Stock Price Time Series Generation Framework

Tucker Balch, Haibei Zhu, Svitlana Vyetrenko

No citations found for this paper.

Comments (0)