Authors

Summary

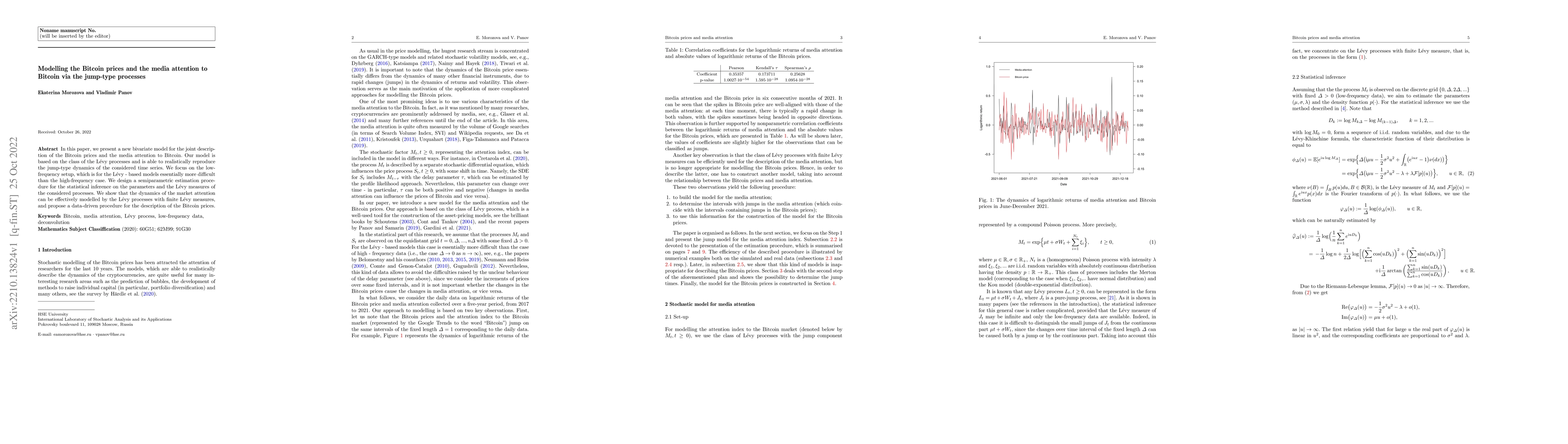

In this paper, we present a new bivariate model for the joint description of the Bitcoin prices and the media attention to Bitcoin. Our model is based on the class of the L\'evy processes and is able to realistically reproduce the jump-type dynamics of the considered time series. We focus on the low-frequency setup, which is for the L\'evy - based models essentially more difficult than the high-frequency case. We design a semiparametric estimation procedure for the statistical inference on the parameters and the L\'evy measures of the considered processes. We show that the dynamics of the market attention can be effectively modelled by the L\'evy processes with finite L\'evy measures, and propose a data-driven procedure for the description of the Bitcoin prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBitcoin option pricing: A market attention approach

Alet Roux, Alvaro Guinea Julia

No citations found for this paper.

Comments (0)