Summary

Online double auctions (DAs) model a dynamic two-sided matching problem with private information and self-interest, and are relevant for dynamic resource and task allocation problems. We present a general method to design truthful DAs, such that no agent can benefit from misreporting its arrival time, duration, or value. The family of DAs is parameterized by a pricing rule, and includes a generalization of McAfee's truthful DA to this dynamic setting. We present an empirical study, in which we study the allocative-surplus and agent surplus for a number of different DAs. Our results illustrate that dynamic pricing rules are important to provide good market efficiency for markets with high volatility or low volume.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

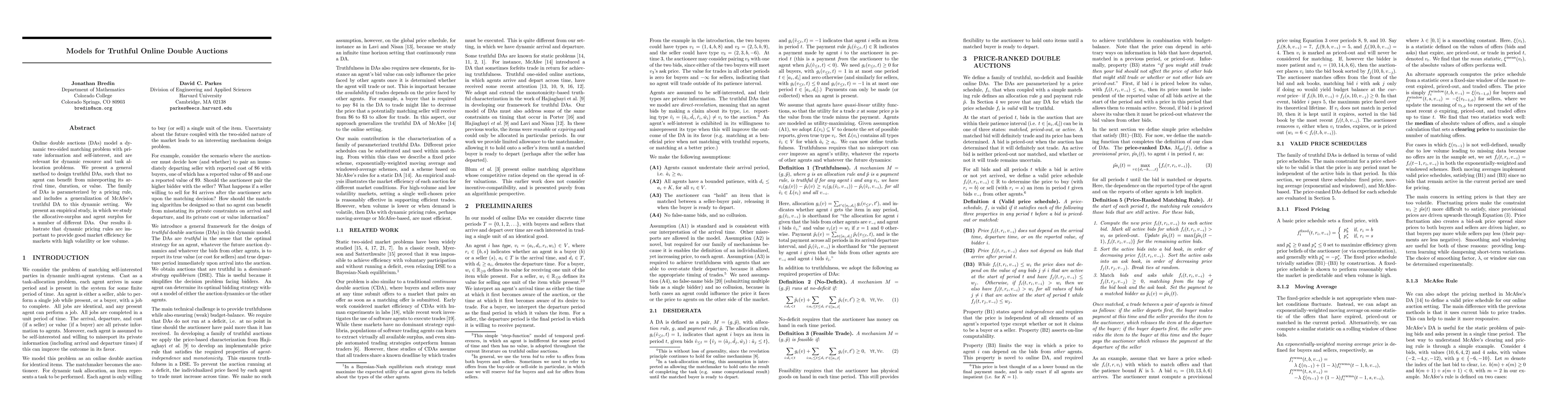

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTruthful Auctions for Automated Bidding in Online Advertising

Jian Xu, Guihai Chen, Zhilin Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)