Summary

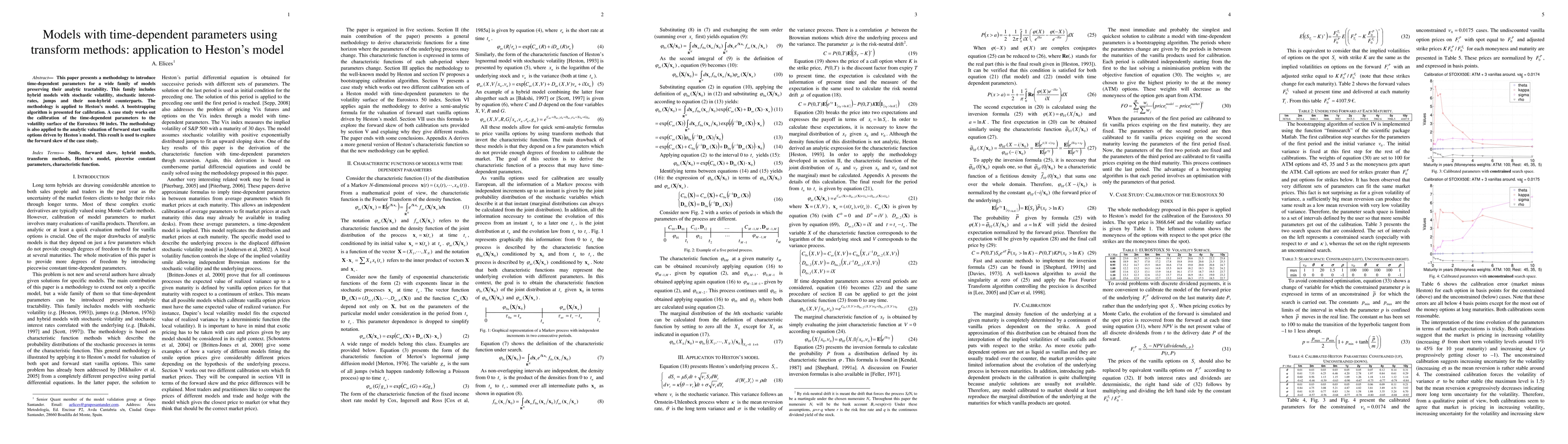

This paper presents a methodology to introduce time-dependent parameters for a wide family of models preserving their analytic tractability. This family includes hybrid models with stochastic volatility, stochastic interest-rates, jumps and their non-hybrid counterparts. The methodology is applied to Heston's model. A bootstrapping algorithm is presented for calibration. A case study works out the calibration of the time-dependent parameters to the volatility surface of the Eurostoxx 50 index. The methodology is also applied to the analytic valuation of forward start vanilla options driven by Heston's model. This result is used to explore the forward skew of the case study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep learning-based estimation of time-dependent parameters in Markov models with application to nonlinear regression and SDEs

Paweł Przybyłowicz, Martyna Wiącek, Andrzej Kałuża et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)