Summary

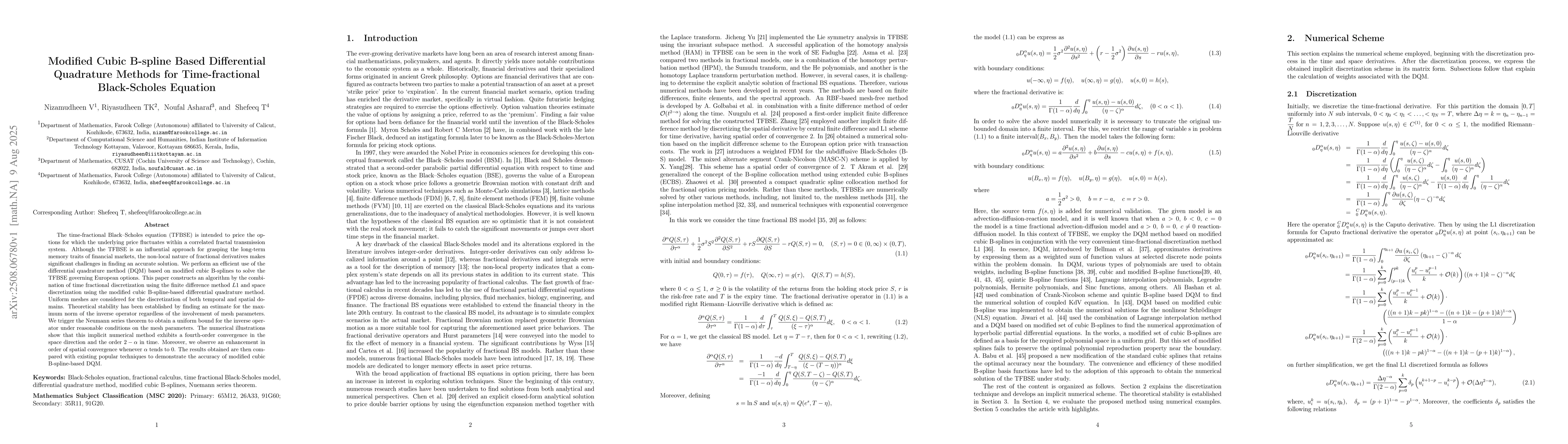

The time-fractional Black-Scholes equation (TFBSE) is intended to price the options for which the underlying price fluctuates within a correlated fractal transmission system. Although the TFBSE is an influential approach for grasping the long-term memory traits of financial markets, the non-local nature of fractional derivatives makes significant challenges in finding an accurate solution. We perform an efficient use of the differential quadrature method (DQM) based on modified cubic B-splines to solve the TFBSE governing European options. This paper constructs an algorithm by the combination of time fractional discretization using the finite difference method $L1$ and space discretization using the modified cubic B-spline-based differential quadrature method. Uniform meshes are considered for the discretization of both temporal and spatial domains. Theoretical stability has been established by finding an estimate for the maximum norm of the inverse operator regardless of the involvement of mesh parameters. We trigger the Neumann series theorem to obtain a uniform bound for the inverse operator under reasonable conditions on the mesh parameters. The numerical illustrations show that this implicit numerical method exhibits a fourth-order convergence in the space direction and the order $2-\alpha$ in time. Moreover, we observe an enhancement in order of spatial convergence whenever $\alpha$ tends to $0$. The results obtained are then compared with existing popular techniques to demonstrate the accuracy of modified cubic B-spline-based DQM.

AI Key Findings

Generated Aug 14, 2025

Methodology

The research proposes an implicit numerical scheme for solving the Time-fractional Black-Scholes Equation (TFBSE) using a combination of the L1 finite difference method for time-fractional derivative and modified cubic B-spline-based differential quadrature method for spatial derivative on uniform meshes.

Key Results

- The proposed method demonstrates fourth-order convergence in the spatial direction.

- The method exhibits order $2-\alpha$ in time.

- An enhancement in the order of spatial convergence is observed as $\alpha$ tends to 0, reflecting the memory effects in the fractional model.

- The numerical method outperforms existing conventional methods in terms of solution accuracy.

Significance

This research is significant as it presents an efficient and accurate method for pricing European options in financial markets with long-term memory traits, which are better captured by the TFBSE than traditional Black-Scholes models.

Technical Contribution

The paper introduces a stable, high-order accurate numerical scheme for TFBSE using modified cubic B-spline-based DQM, supported by theoretical stability analysis via Neumann series theorem.

Novelty

The novelty lies in the efficient use of modified cubic B-spline DQM combined with L1 finite difference method for time-fractional derivative, providing superior accuracy and stability compared to existing methods for solving TFBSE.

Limitations

- The paper does not discuss potential computational complexities that may arise with increasing mesh sizes or higher-order accuracy requirements.

- Limited comparison with non-DQM-based methods could restrict the generalizability of the proposed method's superiority.

Future Work

- Investigate computational efficiency and scalability for large-scale problems.

- Extend the method to other option pricing models or financial applications.

Comments (0)