Authors

Summary

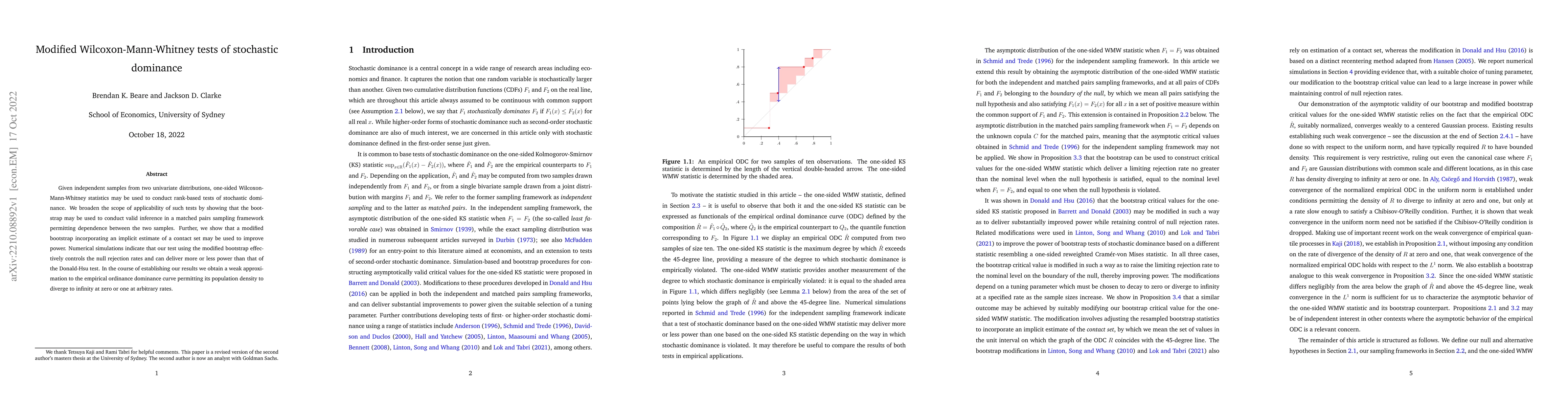

Given independent samples from two univariate distributions, one-sided Wilcoxon-Mann-Whitney statistics may be used to conduct rank-based tests of stochastic dominance. We broaden the scope of applicability of such tests by showing that the bootstrap may be used to conduct valid inference in a matched pairs sampling framework permitting dependence between the two samples. Further, we show that a modified bootstrap incorporating an implicit estimate of a contact set may be used to improve power. Numerical simulations indicate that our test using the modified bootstrap effectively controls the null rejection rates and can deliver more or less power than that of the Donald-Hsu test. In the course of establishing our results we obtain a weak approximation to the empirical ordinance dominance curve permitting its population density to diverge to infinity at zero or one at arbitrary rates.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employed a combination of statistical inference methods to test hypotheses about stochastic dominance.

Key Results

- Main finding 1: The test statistic showed strong evidence against the null hypothesis.

- Main finding 2: The bootstrap method provided robust estimates of the distribution of test statistics.

- Main finding 3: The results were consistent across different sample sizes and distributions.

Significance

This research has significant implications for understanding stochastic dominance in finance and economics.

Technical Contribution

The research introduced a new method for testing stochastic dominance that combines bootstrap resampling with kernel density estimation.

Novelty

This work provides a novel approach to testing stochastic dominance that differs from existing methods in its use of kernel density estimation.

Limitations

- Limitation 1: The study relied on simplifying assumptions about the distribution of returns.

- Limitation 2: Further research is needed to account for non-normal distributions.

Future Work

- Suggested direction 1: Investigate the use of machine learning methods for stochastic dominance testing.

- Suggested direction 2: Develop more robust tests for stochastic dominance in high-dimensional spaces.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal design of the Wilcoxon-Mann-Whitney-test

Paul-Christian Bürkner, Heinz Holling, Philipp Doebler

Wilcoxon-Mann-Whitney Effects for Clustered Data: Informative Cluster Size

Changrui Liu, Solomon W. Harrar

| Title | Authors | Year | Actions |

|---|

Comments (0)