Summary

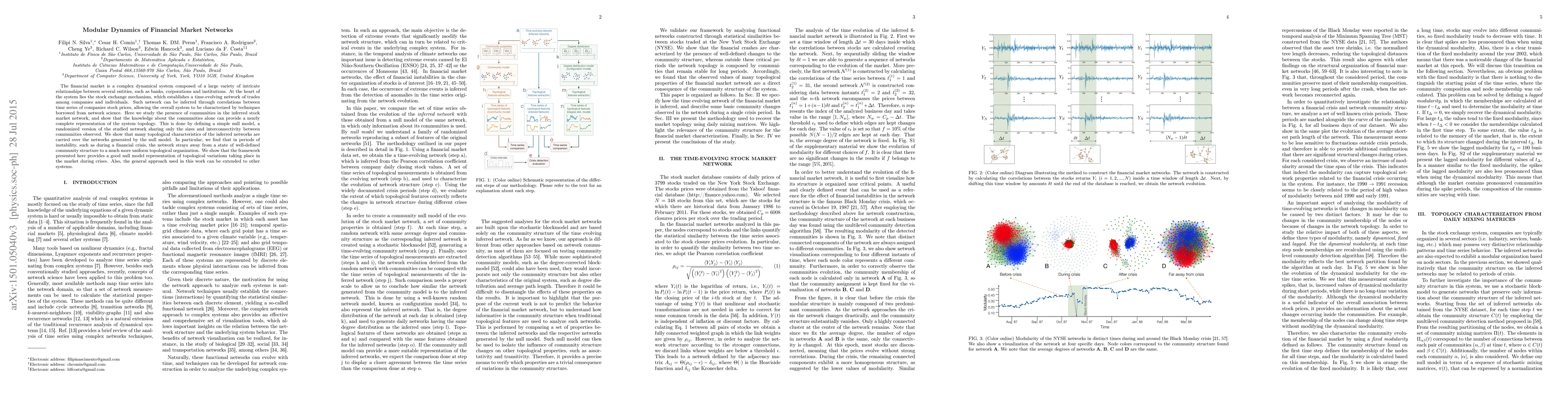

The financial market is a complex dynamical system composed of a large variety of intricate relationships between several entities, such as banks, corporations and institutions. At the heart of the system lies the stock exchange mechanism, which establishes a time-evolving network of trades among companies and individuals. Such network can be inferred through correlations between time series of companies stock prices, allowing the overall system to be characterized by techniques borrowed from network science. Here we study the presence of communities in the inferred stock market network, and show that the knowledge about the communities alone can provide a nearly complete representation of the system topology. This is done by defining a simple null model, a randomized version of the studied network sharing only the sizes and interconnectivity between communities observed. We show that many topological characteristics of the inferred networks are carried over the networks generated by the null model. In particular, we find that in periods of instability, such as during a financial crisis, the network strays away from a state of well-defined community structure to a much more uniform topological organization. We show that the framework presented here provides a good null model representation of topological variations taking place in the market during crises. Also, the general approach used in this work can be extended to other systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)