Authors

Summary

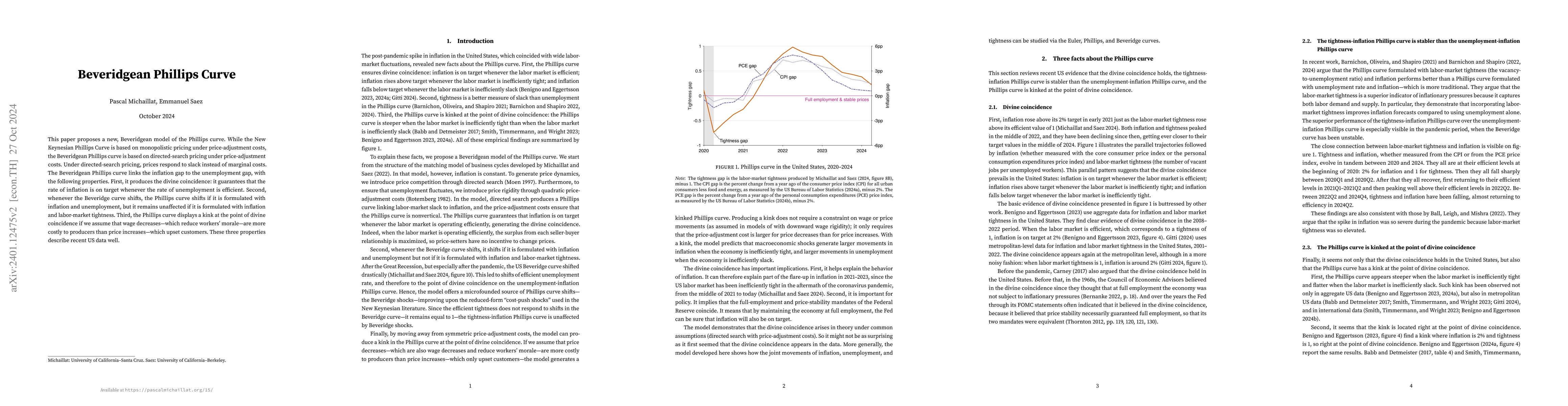

This paper proposes a model of the divine coincidence, explaining its recent appearance in US data. The divine coincidence matters because it helps explain the behavior of inflation after the pandemic, and it guarantees that the full-employment and price-stability mandates of the Federal Reserve coincide. In the model, a Phillips curve relating unemployment to inflation arises from Moen's (1997) directed search. The Phillips curve is nonvertical thanks to Rotemberg's (1982) price-adjustment costs. The model's Phillips curve guarantees that the rate of inflation is on target whenever the rate of unemployment is efficient, generating the divine coincidence. If we assume that wage decreases -- which reduce workers' morale -- are more costly to producers than price increases -- which upset customers -- the Phillips curve also displays a kink at the point of divine coincidence.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research uses a linearized model to analyze the effects of monetary policy on aggregate demand and supply.

Key Results

- Unemployment falls after the negative aggregate-supply shock under passive monetary policy

- Inflation rises in response to the negative aggregate-supply shock under passive monetary policy

- Efficient unemployment rate increases more than actual unemployment rate

Significance

The research highlights the importance of considering both active and passive monetary policies when analyzing business cycle shocks.

Technical Contribution

The research provides new insights into the effects of negative aggregate-supply shocks under passive monetary policy.

Novelty

The study's focus on the interplay between active and passive monetary policies in response to business cycle shocks is novel and contributes to ongoing debates in macroeconomics

Limitations

- Assumes a specific functional form for the Phillips curve

- Does not account for other potential sources of business cycle fluctuations

Future Work

- Investigating the effects of alternative policy rules on business cycles

- Developing more realistic models of labor market matching and job search

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)