Summary

In the LIBOR market model, forward interest rates are log-normal under their respective forward measures. This note shows that their distributions under the other forward measures of the tenor structure have approximately log-normal tails.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

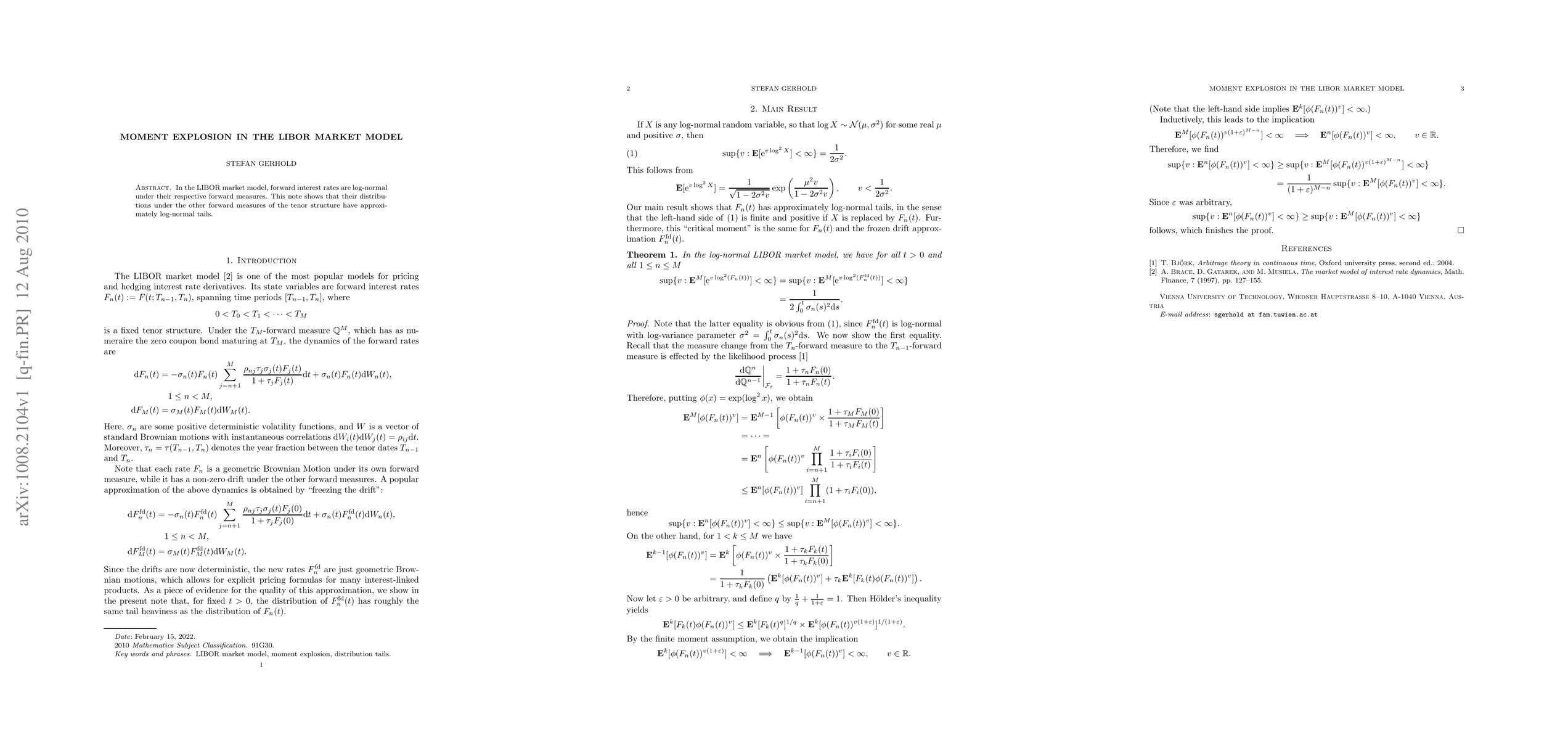

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA mean-field extension of the LIBOR market model

Sascha Desmettre, Simon Hochgerner, Stefan Thonhauser et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)