Summary

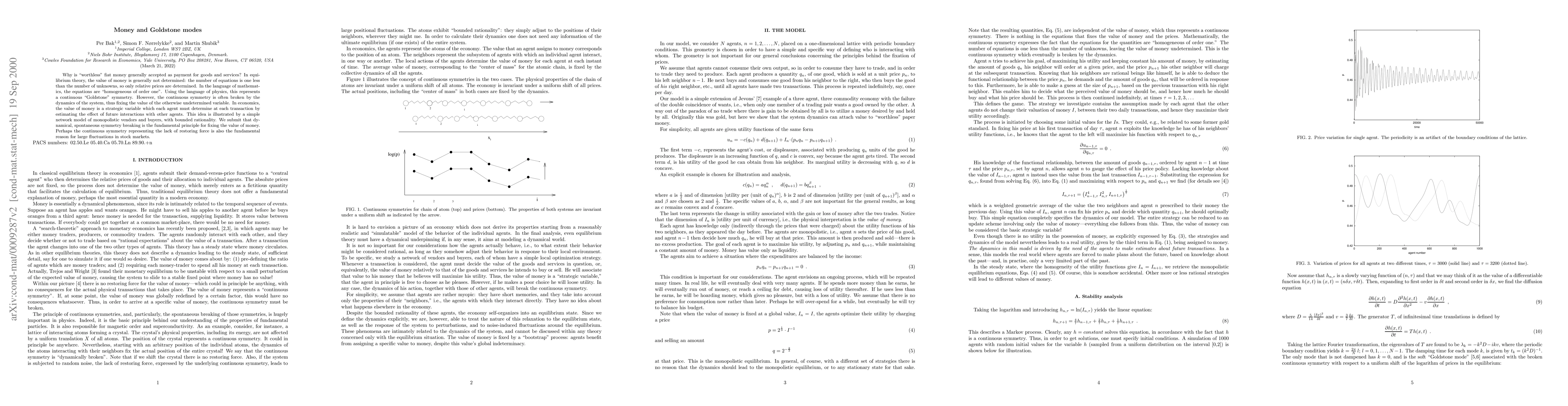

Why is ``worthless'' fiat money generally accepted as payment for goods and services? In equilibrium theory, the value of money is generally not determined: the number of equations is one less than the number of unknowns, so only relative prices are determined. In the language of mathematics, the equations are ``homogeneous of order one''. Using the language of physics, this represents a continuous ``Goldstone'' symmetry. However, the continuous symmetry is often broken by the dynamics of the system, thus fixing the value of the otherwise undetermined variable. In economics, the value of money is a strategic variable which each agent must determine at each transaction by estimating the effect of future interactions with other agents. This idea is illustrated by a simple network model of monopolistic vendors and buyers, with bounded rationality. We submit that dynamical, spontaneous symmetry breaking is the fundamental principle for fixing the value of money. Perhaps the continuous symmetry representing the lack of restoring force is also the fundamental reason for large fluctuations in stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)