Summary

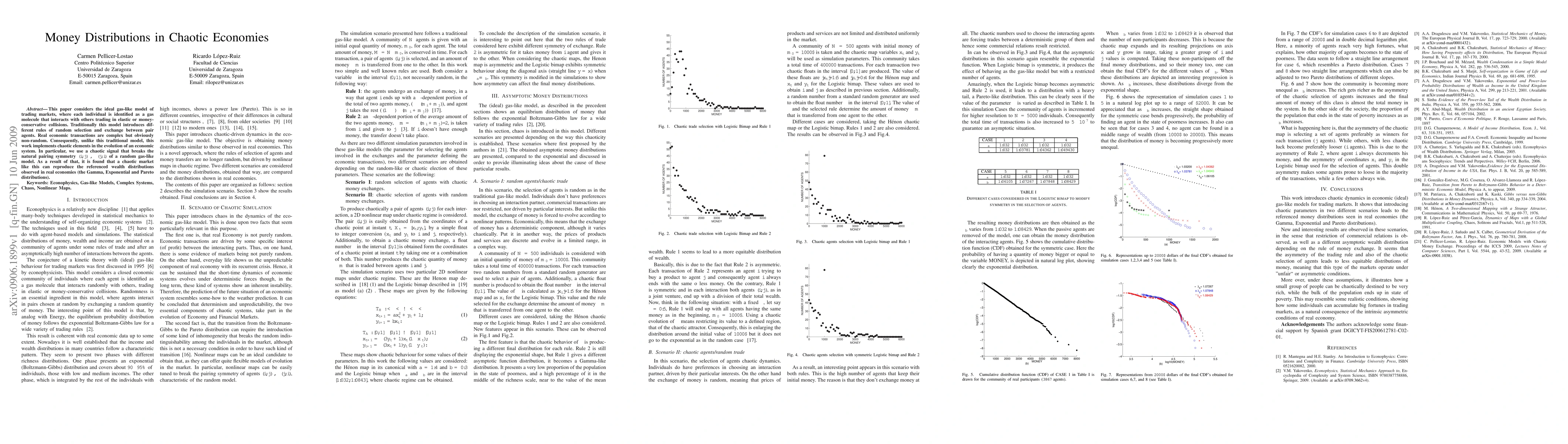

This paper considers the ideal gas-like model of trading markets, where each individual is identified as a gas molecule that interacts with others trading in elastic or money-conservative collisions. Traditionally this model introduces different rules of random selection and exchange between pair agents. Real economic transactions are complex but obviously non-random. Consequently, unlike this traditional model, this work implements chaotic elements in the evolution of an economic system. In particular, we use a chaotic signal that breaks the natural pairing symmetry $(i,j)\Leftrightarrow(j,i)$ of a random gas-like model. As a result of that, it is found that a chaotic market like this can reproduce the referenced wealth distributions observed in real economies (the Gamma, Exponential and Pareto distributions).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFair Money -- Public Good Value Pricing With Karma Economies

Kevin Riehl, Anastasios Kouvelas, Michail Makridis

No citations found for this paper.

Comments (0)