Summary

In this paper, we study the connection between the companies in the Swedish capital market. We consider 28 companies included in the determination of the market index OMX30. The network structure of the market is constructed using different methods to determine the distance between the companies. We use hierarchical clustering methods to find the relation among the companies in each window. Next, we obtain one-dimensional time series of the distances between the clustering trees that reflect the changes in the relationship between the companies in the market over time. The method of statistical process control, namely the Shewhart control chart, is applied to those time series to detect abnormal changes in the financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

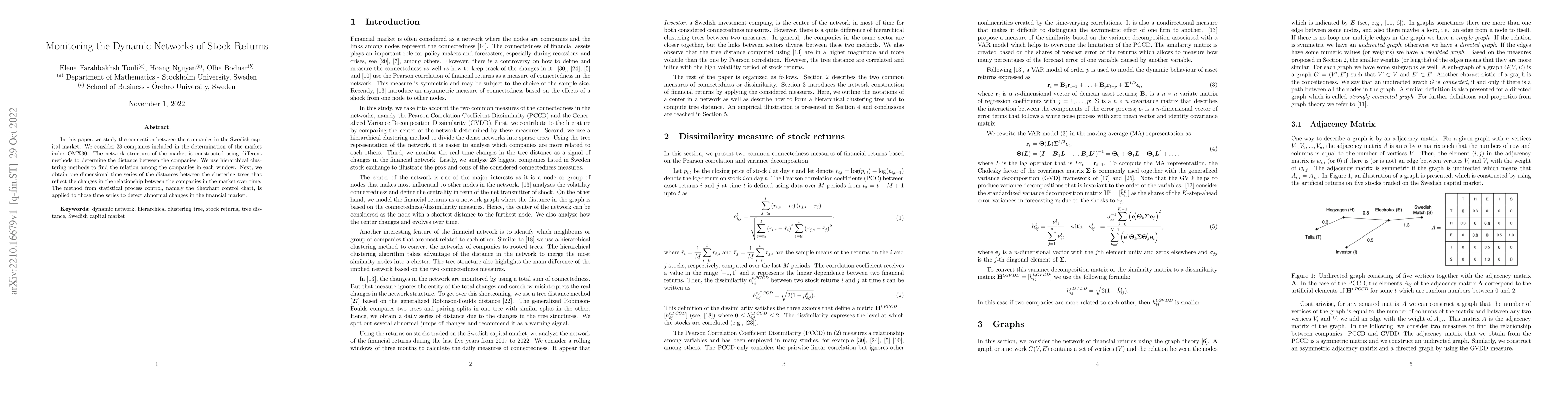

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)