Summary

This paper sets up a methodology for approximately solving optimal investment problems using duality methods combined with Monte Carlo simulations. In particular, we show how to tackle high dimensional problems in incomplete markets, where traditional methods fail due to the curse of dimensionality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

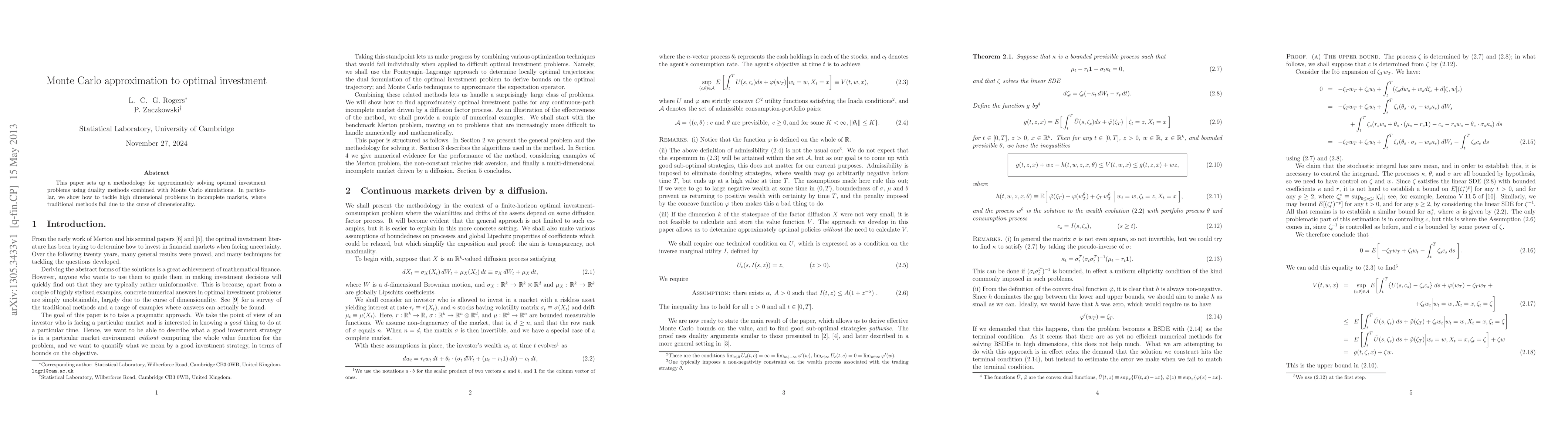

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)