Summary

Valuation of Credit Valuation Adjustment (CVA) has become an important field as its calculation is required in Basel III, issued in 2010, in the wake of the credit crisis. Exposure, which is defined as the potential future loss of a default event without any recovery, is one of the key elementsfor pricing CVA. This paper provides a backward dynamics framework for assessing exposure profiles of European, Bermudan and barrier options under the Heston and Heston Hull-White asset dynamics. We discuss the potential of an efficient and adaptive Monte Carlo approach, the Stochastic Grid Bundling Method}(SGBM), which employs the techniques of simulation, regression and bundling. Greeks of the exposure profiles can be calculated in the same backward iteration with little extra effort. Assuming independence between default event and exposure profiles, we give examples of calculating exposure, CVA and Greeks for Bermudan and barrier options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

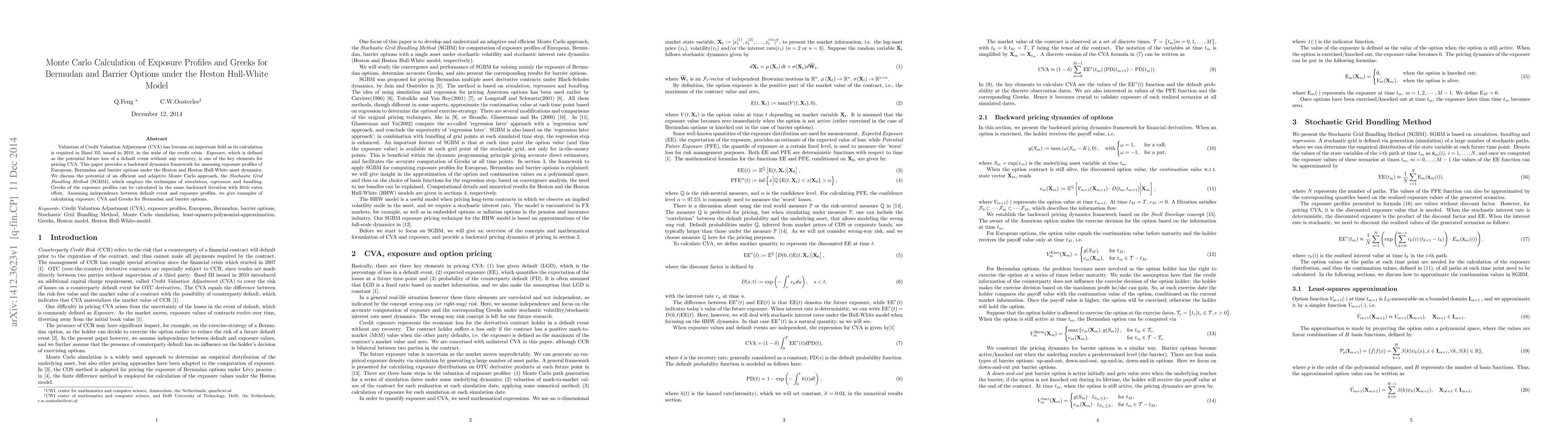

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing Bermudan Swaption under Two Factor Hull-White Model with Fast Gauss Transform

Yuki Takeuchi, Tomohisa Yamakami

| Title | Authors | Year | Actions |

|---|

Comments (0)