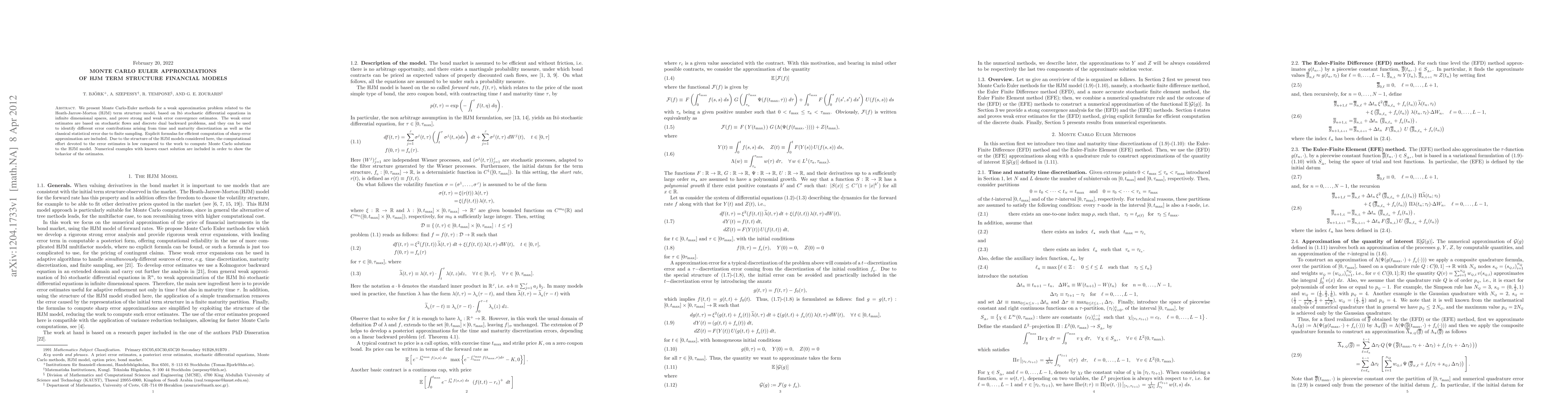

Summary

We present Monte Carlo-Euler methods for a weak approximation problem related to the Heath-Jarrow-Morton (HJM) term structure model, based on \Ito stochastic differential equations in infinite dimensional spaces, and prove strong and weak error convergence estimates. The weak error estimates are based on stochastic flows and discrete dual backward problems, and they can be used to identify different error contributions arising from time and maturity discretization as well as the classical statistical error due to finite sampling. Explicit formulas for efficient computation of sharp error approximation are included. Due to the structure of the HJM models considered here, the computational effort devoted to the error estimates is low compared to the work to compute Monte Carlo solutions to the HJM model. Numerical examples with known exact solution are included in order to show the behavior of the estimates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMonte Carlo method and the random isentropic Euler system

Eduard Feireisl, Mária Lukáčová-Medvid'ová, Hana Mizerová et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)