Summary

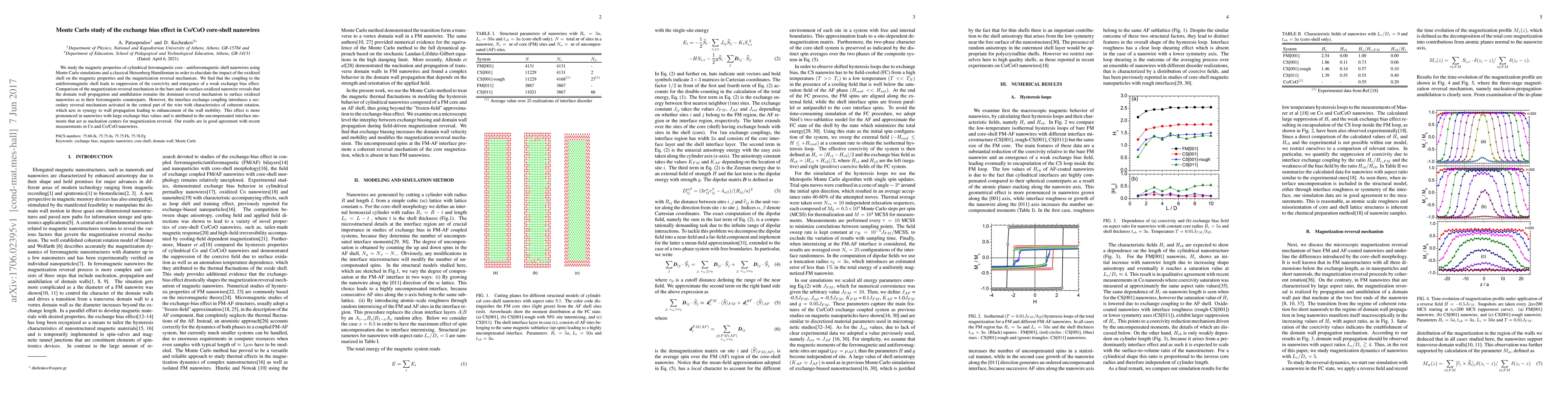

We study the magnetic properties of cylindrical ferromagnetic core - antiferromagnetic shell nanowires using Monte Carlo simulations and a classical Heisenberg Hamiltonian in order to elucidate the impact of the oxidized shell on the magnetic properties and the magnetization reversal mechanism. We find that the coupling to the antiferromagnetic shell leads to suppression of the coercivity and emergence of a weak exchange bias effect. Comparison of the magnetization reversal mechanism in the bare and the surface-oxidized nanowire reveals that the domain wall propagation and annihilation remains the dominant reversal mechanism in surface oxidized nanowires as in their ferromagnetic counterparts. However, the interface exchange coupling introduces a secondary reversal mechanism activated in the central part of the wire with characteristics of coherent rotation, which acts in synergy to wall propagation leading to enhancement of the wall mobility. This effect is more pronounced in nanowires with large exchange bias values and is attributed to the uncompensated interface moments that act as nucleation centers for magnetization reversal. Our results are in good agreement with recent measurements in Co and Co/CoO nanowires.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDependence of Exchange Bias on Interparticle Interactions in Co/CoO Core/shell Nanostructures

S. Goswami, Òscar Iglesias, S. Nayak et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)