Authors

Summary

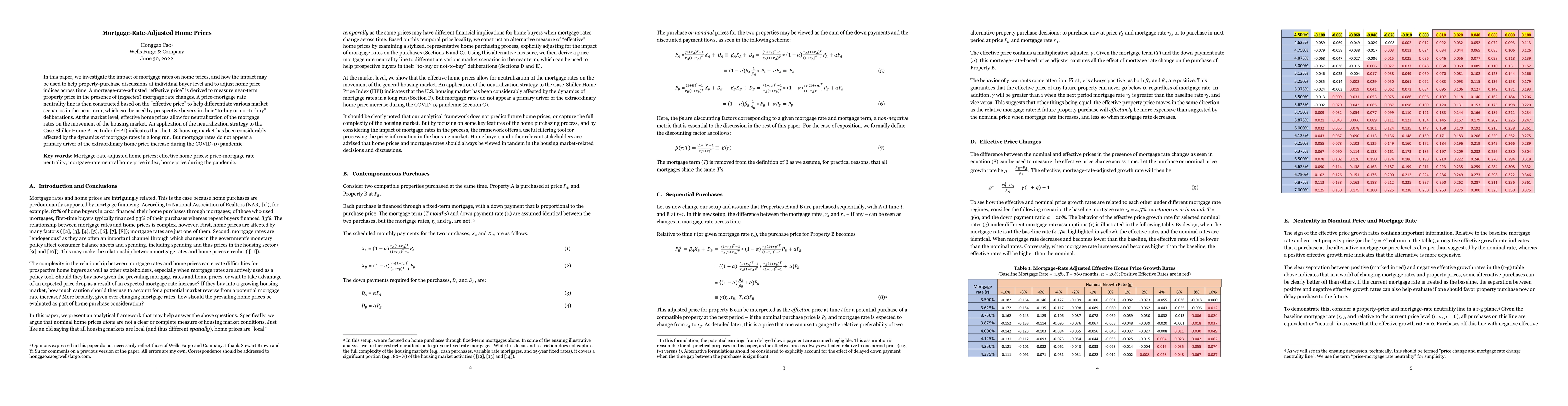

In this paper, we investigate the impact of mortgage rates on home prices, and how the impact may be used to help property purchase discussions at individual buyer level and to adjust home price indices across time. A mortgage-rate-adjusted "effective price" is derived to measure near term property price in the presence of (expected) mortgage rate changes. A price-mortgage rate neutrality line is then constructed based on the "effective price" to help differentiate various market scenarios in the near term, which can be used by prospective buyers in their "to-buy or not-to-buy" deliberations. At the market level, effective home prices allow for neutralization of mortgage rates on the movement of the housing market. An application of the neutralization strategy to the Case-Shiller Home Price Index (HPI) indicates that the U.S. housing market has been considerably affected by the dynamics of mortgage rates in a long run. But mortgage rates do no appear a primary driver of the extraordinary home price increase during the COVID-19 pandemic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBinary AddiVortes: (Bayesian) Additive Voronoi Tessellations for Binary Classification with an application to Predicting Home Mortgage Application Outcomes

Adam J. Stone, Emmanuel Ogundimu, John Paul Gosling

No citations found for this paper.

Comments (0)