Summary

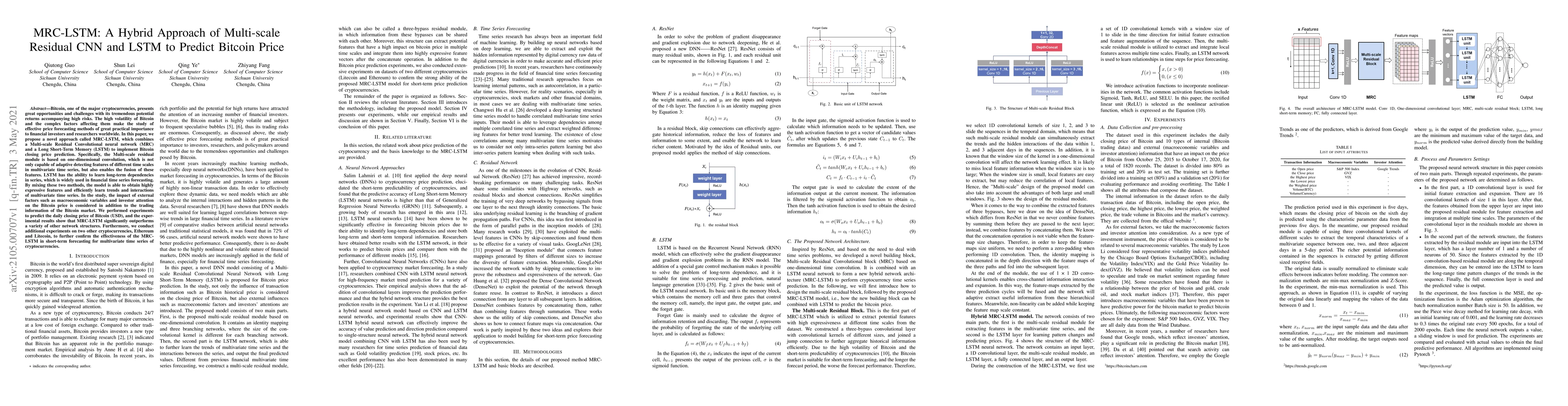

Bitcoin, one of the major cryptocurrencies, presents great opportunities and challenges with its tremendous potential returns accompanying high risks. The high volatility of Bitcoin and the complex factors affecting them make the study of effective price forecasting methods of great practical importance to financial investors and researchers worldwide. In this paper, we propose a novel approach called MRC-LSTM, which combines a Multi-scale Residual Convolutional neural network (MRC) and a Long Short-Term Memory (LSTM) to implement Bitcoin closing price prediction. Specifically, the Multi-scale residual module is based on one-dimensional convolution, which is not only capable of adaptive detecting features of different time scales in multivariate time series, but also enables the fusion of these features. LSTM has the ability to learn long-term dependencies in series, which is widely used in financial time series forecasting. By mixing these two methods, the model is able to obtain highly expressive features and efficiently learn trends and interactions of multivariate time series. In the study, the impact of external factors such as macroeconomic variables and investor attention on the Bitcoin price is considered in addition to the trading information of the Bitcoin market. We performed experiments to predict the daily closing price of Bitcoin (USD), and the experimental results show that MRC-LSTM significantly outperforms a variety of other network structures. Furthermore, we conduct additional experiments on two other cryptocurrencies, Ethereum and Litecoin, to further confirm the effectiveness of the MRC-LSTM in short-term forecasting for multivariate time series of cryptocurrencies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA novel diffusion recommendation algorithm based on multi-scale cnn and residual lstm

Yong Niu, Xing Xing, Zhichun Jia et al.

A Hybrid CNN-LSTM Approach for Laser Remaining Useful Life Prediction

Stephan Pachnicke, Khouloud Abdelli, Helmut Griesser

| Title | Authors | Year | Actions |

|---|

Comments (0)