Summary

Liquidation is the process of selling a large number of shares of one stock sequentially within a given time frame, taking into consideration the costs arising from market impact and a trader's risk aversion. The main challenge in optimizing liquidation is to find an appropriate modeling system that can incorporate the complexities of the stock market and generate practical trading strategies. In this paper, we propose to use multi-agent deep reinforcement learning model, which better captures high-level complexities comparing to various machine learning methods, such that agents can learn how to make the best selling decisions. First, we theoretically analyze the Almgren and Chriss model and extend its fundamental mechanism so it can be used as the multi-agent trading environment. Our work builds the foundation for future multi-agent environment trading analysis. Secondly, we analyze the cooperative and competitive behaviours between agents by adjusting the reward functions for each agent, which overcomes the limitation of single-agent reinforcement learning algorithms. Finally, we simulate trading and develop an optimal trading strategy with practical constraints by using a reinforcement learning method, which shows the capabilities of reinforcement learning methods in solving realistic liquidation problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

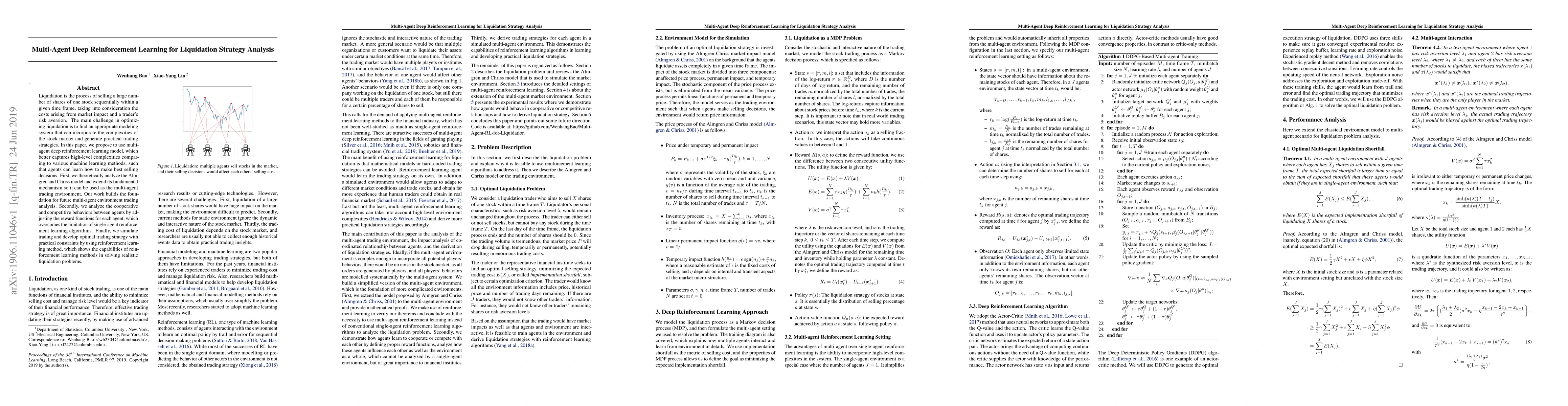

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Multi-Agent Interaction

Cheng Wang, Balint Gyevnar, Stefano V. Albrecht et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)